UPDATE: Novelis restarts casting operations at Greensboro plant after March 1 explosion

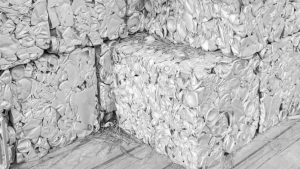

Novelis has restarted casting operations at its Greensboro, Georgia, recycling facility after a March 1 explosion temporarily halted production.

Novelis has restarted casting operations at its Greensboro, Georgia, recycling facility after a March 1 explosion temporarily halted production.

Global beverage can shipments grew by 3% for the full year versus the prior year. Of that, 5% growth was from the Americas.

Novelis temporarily halted operations at its Georgia recycling and casting plant following a March 1 equipment explosion. No reported injuries.

Executives said the company was not materially exposed to changes in the prices of primary aluminum since it operates a pass-through business model. But other metal costs have come into play.

Kaiser Aluminum expects shipment growth in aerospace and packaging in 2026 as plate capacity returns and coated can sheet volumes increase, while automotive retools for specialty expansion.

The causes of the fires are still under investigation.

January AMU survey results show firmer Midwest premium expectations, stabilizing UBC outlooks, and a split between recycler responses and those of producers, manufacturers, and traders.

The move comes as pressure is increasing to keep scrap at home but US tariff exemptions have made exports more appealing.

Decisions to swap materials are not made in the spur of the moment. Significant engineering changes have to be made, tooling has to be redesigned. With current lead times for heavy industrial equipment, substitution could take 1-2 years to execute. Substitution, whether good or bad for aluminum, is not happening quickly.

Anheuser-Busch InBev has repurchased a minority stake in its US metal can manufacturing operations, reversing a $3 billion transaction completed in 2020.