RMU Survey: Prices for ferrous, non-ferrous unlikely to fall soon

On the ferrous side, about two-thirds of the respondents indicated ferrous scrap prices would remain stable, while one-quarter thought they would rise in May.

On the ferrous side, about two-thirds of the respondents indicated ferrous scrap prices would remain stable, while one-quarter thought they would rise in May.

The global copper market is still tight due to situations like the shut down of First Quantum’s Cobre Panama mine, taking production off the market.

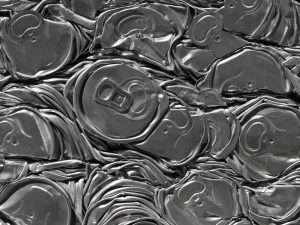

Non-ferrous recycled metals market faces slow flow despite high demand.

RMU anticipates participating, connecting with fellow attendees, and absorbing insights from over 150 speakers.

“Without question, current conditions in the scrap markets remain challenging,” Tamara Lundgren, chairman and CEO, said.

Recent events, such as the Francis Scott Key Bridge collapse, have caused disruptions in supply chains.

Spreads were widening towards the end of March but looks to be slight retreat to start the April.

For April, a majority of respondents said they expect ferrous scrap prices to rise.

The projects are part of a larger, $6-billion DOE agenda funded by the Infrastructure Investment and Jobs Act (IIJA) and the Inflation Reduction Act (IRA).