Global Trade

January 15, 2026

Trump administration takes stake in Atalco to boost alumina, gallium production

Written by Stephanie Ritenbaugh

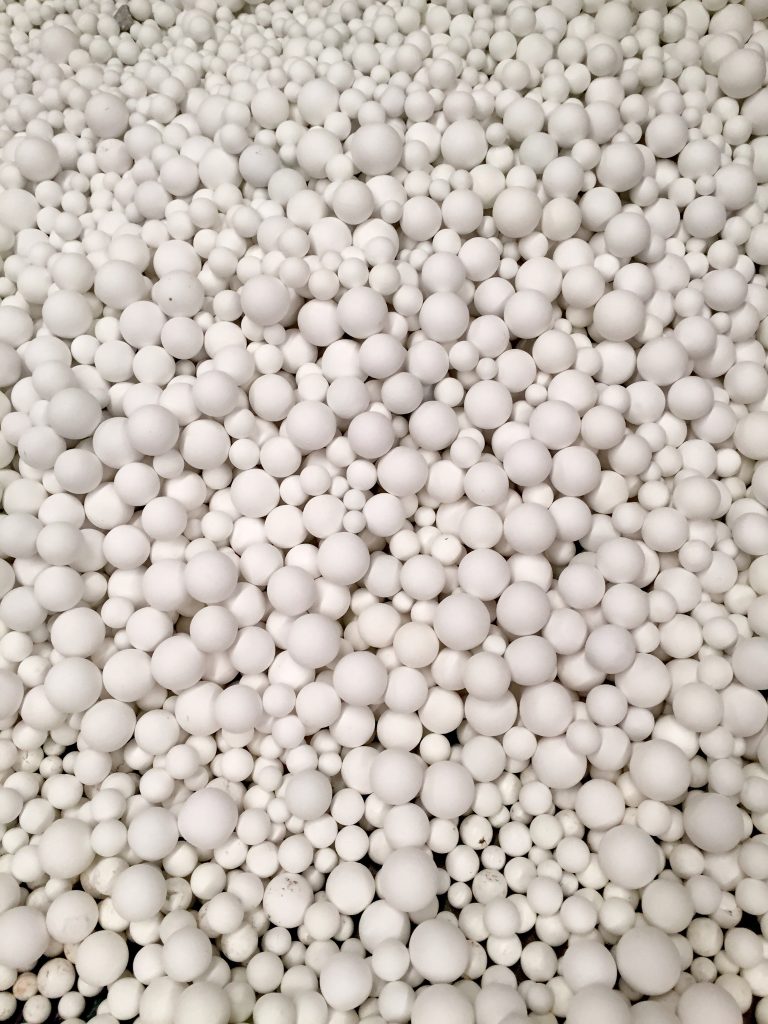

The US Department of Defense (DOD) is taking a $150 million stake in Atlantic Alumina Company LLC (Atalco) to expand production of alumina and establish production of gallium, a critical component of satellite systems, semiconductors, energy technology, and other military and aerospace applications.

Atlaco, the only operating alumina refinery in the United States, has been operating since 1959 in Gramercy, LA.

The partnership also includes more than $300 million from Concord Resources Holdings Limited, in conjunction with Concord’s majority shareholder, a fund managed by Pinnacle Asset Management, L.P., a commodities investment firm with about $6 billion under management. Atalco is owned by Concord Resources, which in turn is owned by Pinnacle.

This is the latest example of the Trump administration investing directly in companies – a prime example in the metals industry is the “golden share” in Pittsburgh-based U.S. Steel Corp. as part of its purchase by Japan’s Nippon Steel.

With the new backing, Atalco expects to produce over 1 million metric tons of alumina per year and up to 50 metric tons of gallium per year at its Louisiana facility. The plant employs about 500 people, the majority of whom are represented by the United Steelworkers.

“Aligning this essential public-sector support with private-sector investment will secure onshore supply of alumina and gallium, which are contested commodity market segments currently dominated by China,” Atalco said in a statement provided to AMU.

The deal will help revitalize the Gramercy plant as Atalco brings its existing facility back to nameplate production, while designing and constructing a new gallium production circuit, according to the company.

The DOD’s Industrial Base Analysis and Sustainment program is investing $150 million of preferred equity in Atalco. Pinnacle will invest more than $300 million in private capital. The federal government will provide “additional funding” within 30 days of closing.

“For the past decade, our investment philosophy has centered on bolstering the US supply chain for critical minerals and other commodities,” said Jason Kellman, chief investment officer at Pinnacle, in a statement. “This strategic partnership plays an important role in strengthening our country’s critical minerals supply.”

Discovery Bauxite Operations Limited is a part of Atalco with a dedicated mining operation, as a joint venture, Discovery Bauxite Partners, with whom the partner is a wholly owned agency of the Government of Jamaica. The mining operation has the capacity to mine and export bauxite to the United States of up to 5.2 million metric tons per annum.