Global Trade

January 21, 2025

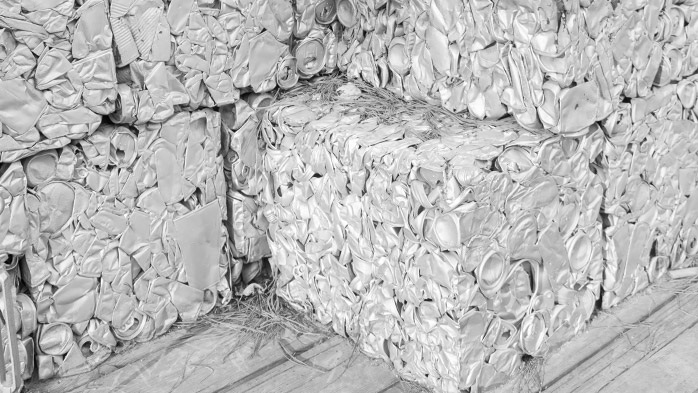

Trump's Playbook: Aluminum day-one, evening update

Written by Gabriella Vagnini

Following up on my article from inauguration day, the evening of the first day showed how the tables can quickly turn. Yesterday, the Trump Administration circulated a day-one action list which did not directly indicate tariffs being implemented. However, fast forward to the evening, and Trump starts signing orders. And while signing the orders, what did Trump stand firm on? You guessed it, tariffs.

The tariffs are coming!

While signing his slew of orders, Trump was vocal about the tariffs, noting that he wants to implement the 25% import tariffs for Canada and Mexico. And to do it as soon as Feb 1.

As aluminum costs are likely to rise and supply chains to strain, The Aluminum Association is trying to work with Trump and mitigate the immediate impact by trying to get some exemptions in place. An A for effort indeed.

Canada – The retaliation

According to the CBC, Canada’s response to Trump’s threats has them preparing to impose retaliatory tariffs. The CBC noted that the Canadian government has identified $37 billion in potential counter tariffs, with additional plans targeting $110 billion in goods.

Under Section 53 of the Customs Tariff Act, Canada can implement or adjust tariffs quickly without parliamentary approval. However, there is now a “Consultation Period” being considered — a 15-to-30-day period that is being looked at to minimize unintended consequences.

The good news is that goods already in transit at the time tariffs are enacted may be exempt. This is still up in the air, but let’s be realistic, the odds of tariffs being implemented at will seems highly unlikely. It will take time for the Canadian border agency to completely change their processes and systems to reflect these new tariffs. We all have witnessed system changes in companies, and I believe we can all agree that it just can’t work that fast.

The big blow

The tariffs will affect both sides of the border in terms of increased costs. And guess who ultimately pays for it? It’s all downstream and will eventually end with the consumers. Some companies may absorb some of the tariff costs, but that’s typically if they’ve hedged their risks. With the LME aluminum market in a backwardation and spreads tightening, one would think that there is too much risk to hedge in such a volatile market. However, from what we’re hearing, theirs forward producer selling on the LME, so that just might provide the downstream market the window to hedging now and mitigate that risk after all.

One of the most realistic quotes I’ve heard in these tariff tussles was from a business professor at Carleton University who said, “When all these Canadians are cheering, ‘Yeah, let’s sock it to the Americans…’ Well, we’re not socking it to the Americans, we’re socking it to Canadians.”

Since Canada is the number one importer of aluminum into the U.S., it’s hard to tell how the tariffs will be beneficial for both sides in the short term.

Stay tuned for further updates.