Global Trade

September 24, 2025

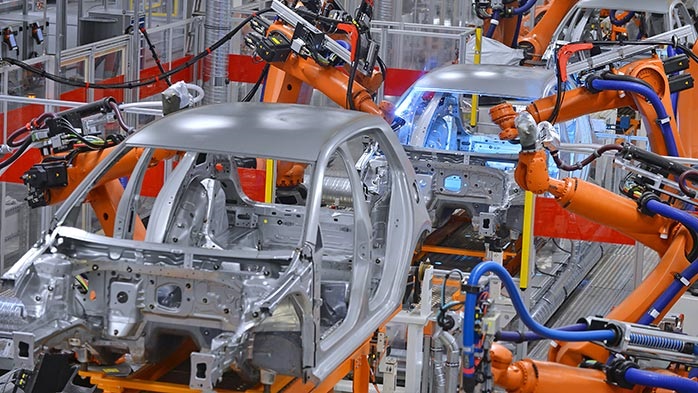

Quantifying Oswego's interruption for the auto industry

Written by Nicholas Bell

Novelis’ Oswego plant remains offline following the fire that broke out early last week.

The facility is the largest producer of automotive alloys in North America and a key supplier to a who’s who list of automakers.

According to CRU production estimates, more than 90% of the site’s projected 2025 flat-rolled product output was dedicated to automotive body sheet and structural sheet, with only a small fraction flowing into the beverage can market.

Anticipated 2025 capacity utilization placed Oswego above its automotive sheet peers, excluding Logan Aluminum mill and Constellium’s Muscle Shoals facility, which is heavily supported by a booming can sheet sector.

That elevated utilization highlights Oswego’s importance to automakers. While industry peers such as Arconic and Commonwealth Rolled Products have underused capacity that could, in theory, be redirected to automotive sheet, the same cannot be said for Novelis’ Kingston, Ontario plant, where tariffs and product focus limit flexibility.

But will a prolonged shutdown of Oswego impact the aluminum market?

Semi-fabricated shortfall

In terms of the semi-fabricated automotive aluminum market, the impact is clear.

First and foremost, it’s worth noting for further calculations a 2022 Alumobility paper noted that about 60% of aluminum sheet consumed in automotive press shops ends up in vehicles, while the remaining 40% returns as scrap.

If the site remains closed for the rest of the year, the effective loss of Oswego’s production in the fourth quarter equates to around a little more than 50,000 metric tons (t) of usable automotive sheet, net of scrap generation.

Any shortfall in supply will be felt most acutely in the truck and large SUV classes, which dominate North American production and carry outsized aluminum content per unit.

Together, large internal combustion engine (ICE) and battery electric vehicles (BEV), classified as D-F by size under the Environmental Protection Agency’s framework, account for nearly nine of every 10 tons of body-in-white (BIW) and closures sheet.

CRU’s segmentation shows the mill would have supplied more than 50% of the half a million tons of BIW and closure sheet required for production intended to be sold in North America – nearly enough to cover the combined needs of midsize and full-sized ICE vehicles, which together account for well over two-thirds of aluminum demand in this segment.

Capacity headroom

On paper, the North American rolling mill industry has the spare capacity to absorb Oswego’s loss.

Collectively, peer mills with automotive sheet output already underway (excluding Aluminum Dynamics’ Columbus mill) have more than 1 million metric tons in excess nameplate capacity, over three times the otherwise anticipated output of automotive sheet from Oswego’s mill for the year.

Two underutilized facilities based on CRU production estimates for 2025: Commonwealth Rolled Products in Kentucky and Arconic’s Knoxville plant, each have spare capacity equivalent to more than three-quarters of Oswego’s lost tonnage.

On a proportional basis, distributing Oswego’s theoretical lost fourth-quarter volume of 85,000t of automotive flat rolled products across the seven North American mills with spare capacity would yield allocations ranging from just a few hundred tons to a smaller player like Golden Aluminum to nearly 20,000t to Commonwealth Rolled Products.

Other major mills such as Arconic’s Knoxville and Davenport sites, Logan Aluminum, Constellium Muscle Shoals, and Novelis’ Kingston plant in Canada would each take between 6,000t-19,000t.

After accounting for the 40% scrap generation rate mentioned earlier, those quarterly allocations translate into roughly 1.2 million vehicles’ worth of BIW/closures aluminum content spread across the market.

Broken down by segment, that’s the sheet needed for just under 700,000 full-size ICE trucks and SUV’s, just under 400,000 smaller ICE cars and crossovers, just under 100,000 large BEV platforms, and a little more than 10,000 smaller BEVs combined.

Import backfill

Making up loss tonnage by importing semi-fabricated aluminum comes at a substantial cost under the Section 232 duty rate of 50%.

In fact, it might make sense to import a fully assembled car rather than its major component feedstock at elevated prices, though supply chains do not pivot so easily.

Nevertheless, automotive aluminum alloys hold a very narrow niche in the flat-rolled import market.

Excluding steep Canadian imports of plate, sheet, and strip, which could attributed to cross-border processing or transshipments, a large portion of U.S. imports have historically come from the Middle East.

Oman, Bahrain, and Saudi Arabia, in particular, have become more prominent suppliers, while South Korea has increasingly emerged as a source as well. In South Korea’s case, the growing prevalence is largely as a result of Novelis’ expanding operations in the country, where its two rolling mills account for somewhere between half and two-thirds of the country’s rolling capacity, with the balance spread across five other mills. Much of that exported material, however, is presumably beverage can sheet and part of a larger captive supply chain.

Other notable suppliers include Turkey, which operates roughly a dozen rolling mills, and Greece which largely runs a single plant. There is also a Azerbaijani mill, though it does not have substantial capacity and the U.S. is mostly a primary outlet.

When it comes to 6XXX series automotive alloys, 6011/6016/6022, those grades are not widely available globally and tend to be source primarily from European producers.

This makes sense for two reasons. First, the European automotive market was historically second only to North America in vehicles sales until the recent surge in Chinese demand. Second, China’s role as a supplier to the U.S. has been constrained both by tariffs and duties in various forms and by longstanding U.S. trade restrictions, which have shifted raw material procurement elsewhere.

Finally, U.S.-based rolling mills in particular often rely on affiliated overseas plants across the Atlantic to supplement volume. The automotive aluminum market is highly specialized, where margins run higher than common alloy sheet, where producers aim to balance narrow margins with economies of scale.

As a result, Germany, Belgium, France, Austria, Italy, and Switzerland remain key suppliers of 6XXX automotive sheet to the U.S. Constellium has historically produced this material at its German and French operations; Hydro at its German site; Novelis at its Swiss mill, AMAG Austria Metall in Austria; and several Italian mills, including Lamial.

There is more flexibility with 5XXX-series alloys, especially since 5052 is widely used across nearly every aluminum-consuming sector. That is where suppliers such as Saudi Arabia’s Ma’aden Rolling Company and Bahrain’s GARMCO have re-emerged, while more automotive-specific 5XXX series products are still offered by European produces, like ProfilGlass and Laminazione Sottile in Italy, as well ElvalHalcor in Greece.

Conclusion

The Oswego downtime underscores the fragility of North America’s automotive sheet supply chain.

On the surface, idle domestic capacity more than matches the lost volume, yet the practical hurdles of alloy qualification, customer approvals, and commercial realignment mean the gap cannot be erased overnight.

Imports offer another outlet but face tariff headwinds and limited specialization of automotive grades.

For automakers, particularly those heavily invested in aluminum-intensive truck and SUV platforms, the disruption highlights a structural vulnerability: North American production of BIW and closures sheet remains highly concentrated, and when a single plant falters, the ripple effects are felt across the industry.