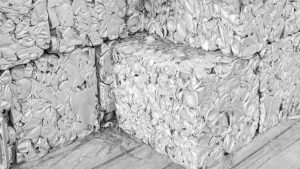

EU scrap export concerns marginal for US can sheet markets

The EU's preparatory work on possible aluminum scrap export restrictions provides the starting point for examining why current European scrap flows to the US remain too small to materially affect either region's can sheet market.