Global Trade

April 16, 2025

Tariff talks define Alcoa's Q1

Written by Nicholas Bell

Quarter ending March 31, 2025

| Production | Q1 25 (1,000’s) | Q1 24 (1,000’s) | Change |

| Aluminum production (metric tons) | 564 | 542 | +4% |

| Alumina production (metric tons) | 2,355 | 2,670 | -12% |

| Bauxite production (dry metric tons) | 9,500 | 10,100 | -6% |

| Deliveries | |||

| Aluminum shipments | 609 | 634 | -4% |

| Third-party alumina shipments | 2,105 | 2,397 | +12% |

| Third-party bauxite shipments | 3,000 | 1,000 | +200% |

Shipment timing and tariff talk define Alcoa’s Q1

Pittsburgh-based aluminum producer Alcoa kicked off earnings season, as far as the aluminum market participants are concerned, with a focus on positioning in the market.

Operational results painted a picture of a company that produced more aluminum but shipped less of it as a result of tariffs and timing mismatches – to no one’s surprise.

Despite all of the developments since the first quarter of last year and especially within the first three months of the current year, capacity ramp-ups and curtailments dictated the picture of today’s earnings release.

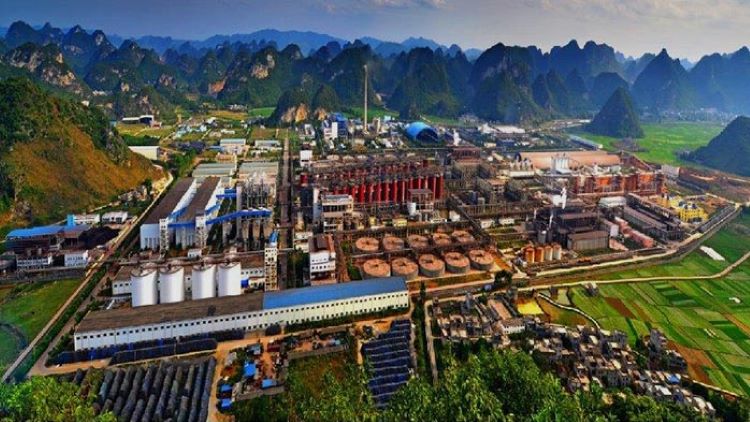

Alcoa’s quarterly primary aluminum production grew by 4% year-over-year to 564,000mt, supported by capacity restarts at the company’s Warrick, Indiana facility and a continued ramp-up of the Alumar smelter in Brazil. Alcoa brought a potline online at Warrick in early 2024, restoring about 6,500t of quarterly capacity.

Aluminum shipments told a different story, falling by an equivalent 4% to 609,000 metric tons (mt) in January-March 2025 from the prior year, which Alcoa attributed to “the absence of Ma’aden offtake volumes and timing of shipments”, after selling its 25.1% stake in the joint venture back in September.

Premiums undershoot expectations, tariffs bite

The company flagged pressure from the U.S. Section 232 aluminum tariffs, which are expected to cost the company around $105M – even with pass-through costs, the majority of which will show up in the second quarter.

Alcoa initially anticipated average quarterly Midwest premium of $880-890/mt (~40¢/lb), but the actual figure settled around $862/mt, according to the company (company representative said they reached that figure by comparing January 31 price point of 24¢/lb as the pre-tariff delivery cost with the premium in the most recent week). The company believes the full impact of tariffs on the Midwest premium has not been fully realized yet.

Upstream curtailments and catch-ups

Alumina production fell by 12pc to 2.36M mt in the most recent quarter from the year earlier period, largely owing to the full curtailment of Alcoa’s Kwinana refinery in Australia. Shipments declined in lockstep by the same percentage to a total 2.1M mt.

That said, Alcoa’s total curtailment of the company’s Kwinana alumina refinery brought the remaining 1.8M mt of the refinery’s 2.2M mt of nameplate capacity offline, pointing to the idea that Alcoa’s other refineries in Australia and Brazil must have sharply upped capacity to make up the difference, even allowing for a 12% drop in production or shipments.

Bauxite back-up cleared after Alcoa’s Juruti mine jam in Brazil

Bauxite production dropped by 6% to 9.5M dry metric tons (mdmt) in the latest quarter from 2024, while bauxite deliveries rose by 200% to 3.0mdmt. Deliveries were likely due to the resolution of a logistical issues stemming from the suspension of deliveries from the company’s Juruti mine late last year.

Interestingly enough, aside from an adjustment to a depreciation expense, Alcoa didn’t adjust their 2025 outlook guidance, despite the macro noise. Their full-year outlook was admittedly focused on operational metrics, which can often weather price fluctuations.

If the first quarter had a them of recalibration, the second quarter could be a narrative of rerouting.

Lingering uncertainty

The current political-economic backdrop of trade policy, tariff realignments, and shifting sourcing strategies understandably leaves Alcoa and market watchers with more questions than answers. Another lingering question is the company currently running at a 98.5% capacity utilization rate across their non-idled aluminum smelters?

2.645M mt of capacity – 359kt idled capacity = 2.286M mt / 4 quarters a year = 572kt….. 564kt of first quarter capacity / 572kt of existing quarterly capacity = 98.5% utilization

During their Q1 2025 earnings call, Aloca pointed out that – “It takes many years to build a new smelter and at least five to six smelters would be required to address the U.S. demand for primary aluminum”.