Aluminum Scrap Markets

September 3, 2025

AMU Survey: Lead times split by product group

Written by Nicholas Bell

Aluminum Market Update’s August survey results are in, and respondents point to a market defined by diverging lead times across product groups.

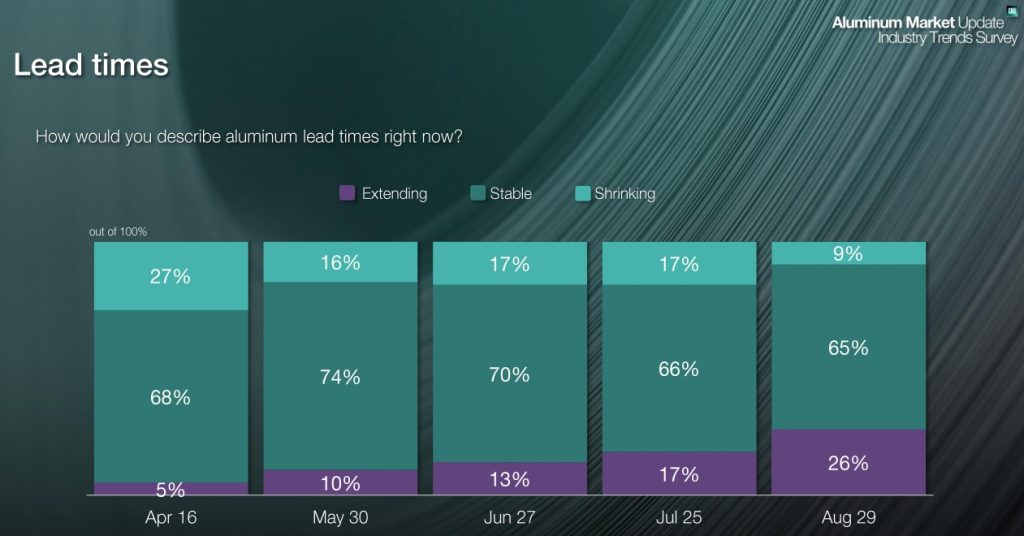

The share of respondents citing “extending lead times” rose to 26% in August from 17% in July, while those who answered “shrinking” fell to 9% in the most recent month.

That perception lines up with the hard numbers for sheet products, which have clearly lengthened.

Common alloy sheet lead times grew by two weeks to 6.4 weeks in August from the prior month, while auto body sheet stretched to 6.3 weeks from only 4.5 weeks in July.

Not every flat-rolled product followed the same trajectory. Can sheet lead times contracted, easing to 4 weeks in August, down from 5.4 weeks last month.

Similarly, extrusion product lead times tightened as well. Mill finished 6061 extrusions averaged a 4.75-week turnaround time from 5.25 in July, while mill finished 6063 extrusion delivery times shrunk by the same margin to 3.75 weeks from 4.25 over the same period.

Primary (6061 or 6063) billet saw the sharpest swing, collapsing to 3.6 weeks from 5.4 weeks, though this may reflect regional variability or alloy grade divergences – especially, as primary P1020 ingot held steady at 4 weeks month-over-month.

Taken together, sheet buyers are clearly experiencing lengthening queues, while billet and extrusion customers are seeing greater breathing room. The result is a fragmented picture: tightening at one end of the value chain, loosening at another, and an overall sentiment that skews stable even as specific product groups diverge.

So, lead times are… stable?

Where does a 65% share of “stable” responses fit into the picture?

The breakdown by respondent type reinforces this split. Distributors and traders made up the bulk of the “stable” camp, consistent with their exposure to P1020 and billet, both of which were flat or only slightly shorter month-to-month.

Producers, by contrast, leaned more toward “extending,” which aligns with their focus on sheet products, where queues lengthened most. Manufacturers and assemblers were divided between stable and extending, likely reflecting their dual exposure to extrusion buying, which eased, and sheet demand, which tightened.

Scrap recyclers and processors were the only group to report shrinking lead times, which dovetails with billet’s sharp contraction and the looser dynamics of scrap-driven inputs.

In other words, the way respondents answered depended less on a universal market view than on their position in the value chain.

Manufacturer and assembler lead times

Taken further, the split among manufacturers and assemblers looks less contradictory once their sector focus is considered.

A majority of survey participants have significant exposure to the building and construction industry.

Their responses track with the broader timing differences visible in AMU analyses of national data (spending/billings/backlog vs. momentum & starts): The Dodge Momentum Index is rising, pointing toward stronger project activity 9-12 months out, even as non-residential starts and private spending have softened in the present.

The Architectural Billings Index is also showing early signs of improvement, albeit in a contraction environment, another leading indicator that precedes physical activity on the ground.

Meanwhile, the Associated Builders and Contractors’ Construction Backlog remains more uneven and depending on sector and project size. Overall construction spending tracked by the Census Bureau shows downward pressure on commercial and manufacturing construction spending in the privately funded sector, while publicly funded and infrastructure sectors are showing an uptick in spending.

That lag structure helps explain the split in survey sentiment.

Manufacturers and assemblers preparing for projects must secure raw material ahead of time, lengthening lead times for certain products. At the same time, softer near-term commercial demand leaves others reluctant to place orders, which shortens or stabilizes lead times elsewhere. The result is a fragmented response that mirrors the uneven pull between forward-looking preparation and present-day hesitation.

Pass-through costs

Respondents were likewise split on the ability to pass through added costs from Section 232 tariffs.

An equal share reported being able to fully pass through costs or partially pass them through at 27%, while the remainder indicated they had limited ability to pass through added expenses (an estimated 50% or less of costs), accounting for roughly 45%.

The burden is uneven: Manufacturers and assemblers can push costs downstream, while recyclers and traders/distributors tend to absorb a larger share of the hit.

The range of the cost fracture highlights who has the pricing power in a supply chain with elevated fixed costs even as demand-side fundamentals remain volatile.

In that vein, more than half of manufacturers and assemblers reported OEMs resisting higher prices by cancelling orders or seeking substitutes, while the remaining share noted little to no resistance to what is otherwise a largely passed-through increase in input costs.

On imports, 65% of respondents see no change in competitiveness, while 30% see imports as less competitive, suggesting that tariffs are continuing to blunt foreign pressure or demand in general.

Scrap dynamics

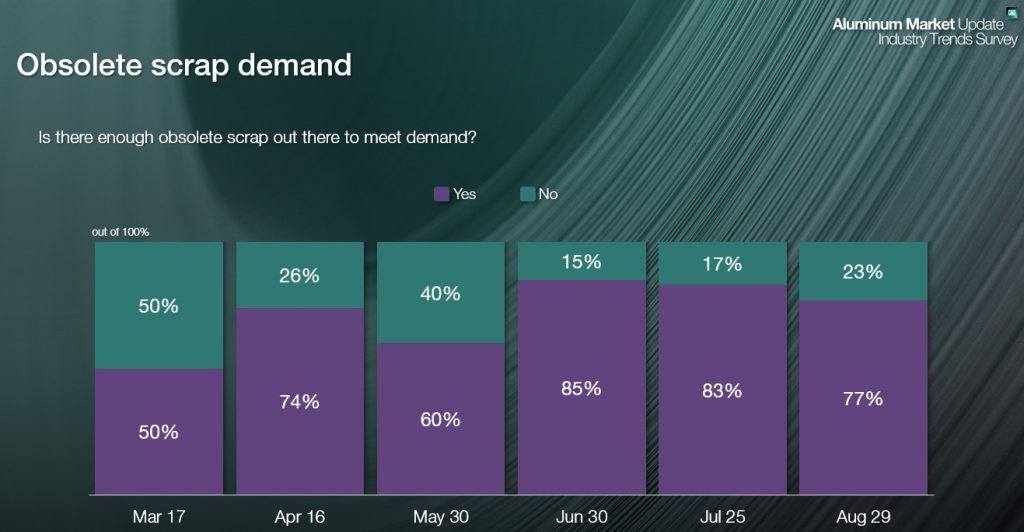

While 79% of respondents say obsolete scrap is sufficient to meet demand, survey comments suggest that “sufficient on paper” does not always equate to timely delivery at the right place. Regional mismatches, collection bottlenecks, and late deliveries remain friction points.

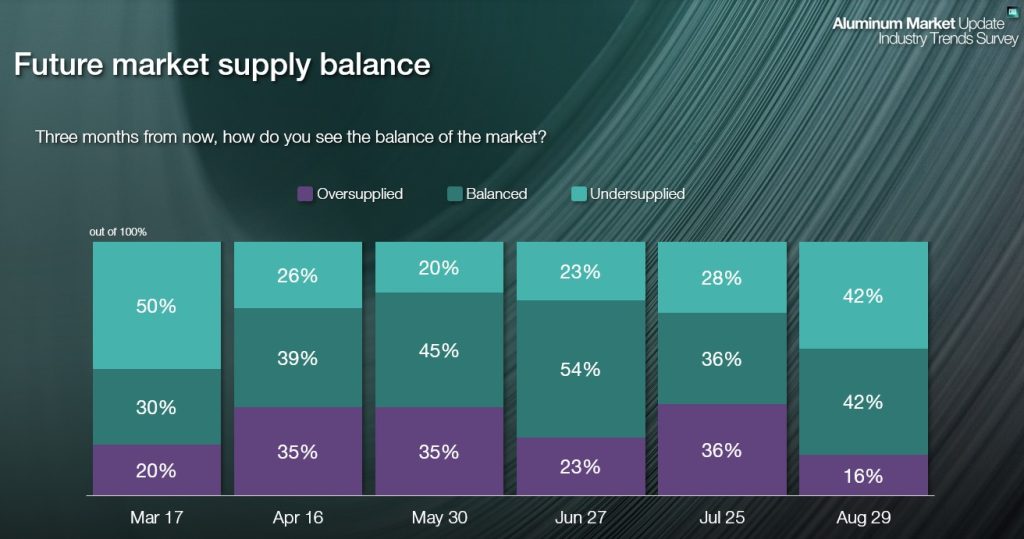

That helps explain why supply-side balance expectations remain divided and even erring on the balanced-to-undersupplied side of possible responses: 46% balanced, 38% undersupplied, and 15% oversupplied three months out.

Conclusion

The survey underscores recurring theme: Respondents remain cautious and deliberate in reaction to inflection points.

Market sentiment tends to stay steady until an unexpected disruption, such as a sudden doubling of tariff rates within a single week, forces a rapid reassessment.

Note: AMU surveys active aluminum market participants regularly to gauge supplier lead times, price pressures, and tariff pass-through. The results reflect current aluminum demand, supply conditions, and sentiment trends. To access the full results and receive AMU’s survey insights directly in your inbox, sign up to participate in future survey.

And if you want to see your company’s experience reflected in our survey, please reach out. All data is confidential. You can contact me at nicholas.bell@crugroup.com to find out more.