Global Trade

May 6, 2025

What CRU’s new outlook could mean for the downstream aluminum market

Written by Gabriella Vagnini

CRU just took a red pen to its global economic forecast and they didn’t hold back. They’re calling this the biggest monthly downgrade since the pandemic, and tariffs are at the center of it.

We’ve now got a fresh wave of duties on steel, aluminum, autos, and auto parts. Tariffs on China have climbed even higher. CRU says this is putting pressure on demand, tightening supply, and creating a mess of uncertainty for anyone trying to plan around it.

That’s the macro view. But what does it mean for the downstream side of the aluminum industry?

Costs are climbing

Tariffs are driving up the price of metal, parts, and freight. For many, those increases are already showing up in quotes and contracts.

Demand could start to slow

CRU flagged signs that U.S. consumers are tapped out, pandemic savings are gone, credit card debt is at record highs, and inflation is still squeezing spending. If buyers pull back, it’s going to ripple down the chain.

Auto is under pressure

The sector’s facing higher costs and new sourcing rules under USMCA. That’s led to trimmed forecasts and more cautious buying. Anyone supplying into auto may start to feel it.

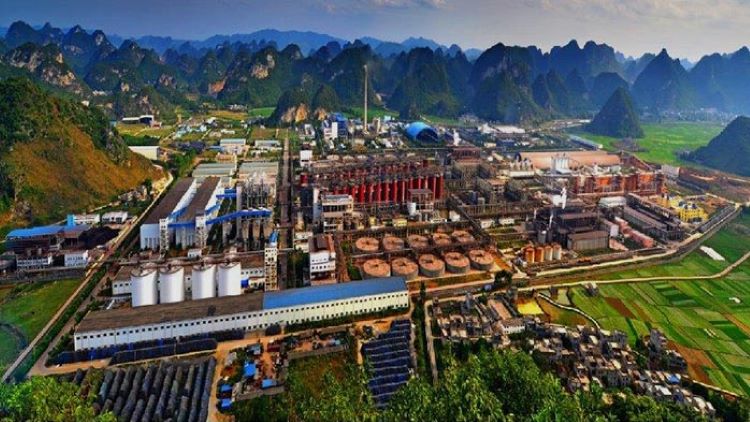

China’s going to redirect exports

With U.S. tariffs so high, China will look to push more metal into other markets, especially value-added products. That could mean more pricing pressure for North American producers and processors.

Buyers are nervous

The mix of inflation, tariffs, and unclear policy is making it harder for customers to commit. If you start hearing about deferrals or price renegotiations, this is why.

The headline takeaway: things aren’t falling apart, but the footing is less stable than it looks. Between policy shifts and softer demand signals, downstream players may need to keep tighter lead times and a closer watch on customer behavior heading into summer.