Global Trade

May 23, 2025

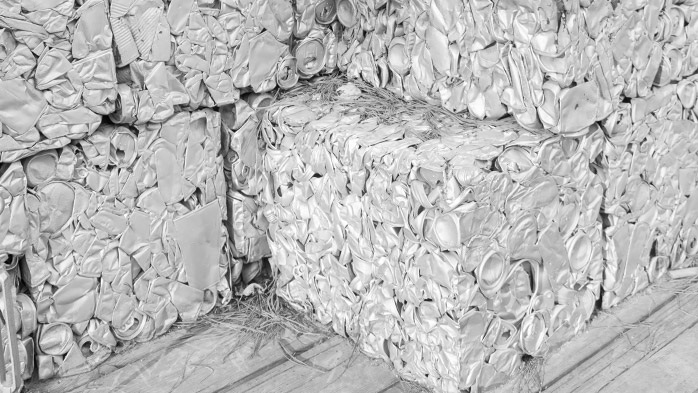

Week-in-review: Smelters, scrap, and a squeeze play

Written by Nicholas Bell

Terminal markets firmed up amid new smelting announcements, tightening bauxite expectations, and jittery macro signals.

Market Moves Recap

- The 3M LME contract dipped early in the week, ended up as much as $17/t higher by mid-week, and settled at $2,468/t – $1/t lower than where it ended last week.

- The 3M SHFE contract rose as high as 20,150/t from 20,085/t last Friday with gains tracking signs of restocking and sentiment shifts in China’s industrial recovery, but softened to 20,100/t.

- Physical aluminum continues to tighten in the terminal markets even as macro conditions remain murky. LME cancelled warrants hit their lowest level since October 2022, driven by higher Chinese demand and falling Russian-origin stocks.

- US aluminum prices faced pressure amid rising dollar strength, macro unease over Trump’s proposed tariffs, and debt ceiling politics.

Smelter and Primary News

- Emirates Global Aluminium (EGA) announced plans to build the first greenfield smelter in the U.S. in 45 years in Oklahoma. Nameplate capacity is pegged at 600,000t/yr and final investment decisions are expected by 2026.

- France’s Aluminum Dunkerque launched its first recycling furnace, capable of processing 7kt of scrap per year and producing an additional 20kt of low-emission billet. Why it could matter: Marks

- Alba launched “Eternal”, a certified low-carbon billet line with embedded GHG offsets and third-party verification.

- International Aluminum Institute data showed global aluminum production rose by 2% year-over-year in April, driven by China and smaller gains in Africa and Europe.

Bauxite, Alumina, and Upstream

- Guinea revoked 51 mining licenses and paused more than 50 others according to local media reporting – over 100 sites affected in total.

- Rio Tinto plans to add 20mn t/yr to Amrun’s bauxite capacity in Queensland, Australia, replacing volumes from Gove and Andoom.

- China’s bauxite imports from Guinea surged in early 2025, with AGB2A and SDM shipping 11.6mn t and 4.3mn t, respectively, through May.

Company Updates

- Hydro is reviewing potential hydropower upgrades at Rjukan, Norway, to boost capacity to 750MW.

- The company also announced the closure of its Birtley extrusion plant in the U.K. this month, which was initially announced during their 2024 earnings presentation.

- Alcoa extended its low=carbon EcoLum supply deal with Prysmian through 2026, exclusively using Icelandic smelting and electric trucking.

Trade and Policy

- Moody’s downgraded US credit outlook from a AAA rating to a Aa1. The firm was a holdout in comparison to other sovereign credit rating agencies that withdrew the top rating from the US before.

- Malaysia-based Press Metal warned of an increased frequency of aluminum supply shock due to U.S.-China tensions on an earnings call.

- Lawmakers criticized the current EU carbon border tax scheme, CBAM, claiming it punishes transparent suppliers while allowing loopholes for scrap imports.

What to watch

| Data Release | Weekday | Date & Time (EST) | Relevance |

| GDP Growth Rate | Thursday | 5/29 – 8:30 AM | Updated calculation of economic growth which is expected to be revised to -0.3% from a previous estimate of +2.4%. |

| Pending Home Sales Index | Thursday | 5/29 – 10:00 AM | Leading indicator for residential housing starts and renovations, an aluminum-heavy industry sector. |

| Core PCE Price Index | Friday | 5/30 – 8:30 AM | The Federal Reserve’s inflation gauge. |

| University of Michigan Consumer Sentiment | Friday | 5/30 – 10:00 AM | Foreshadows discretionary spending. |