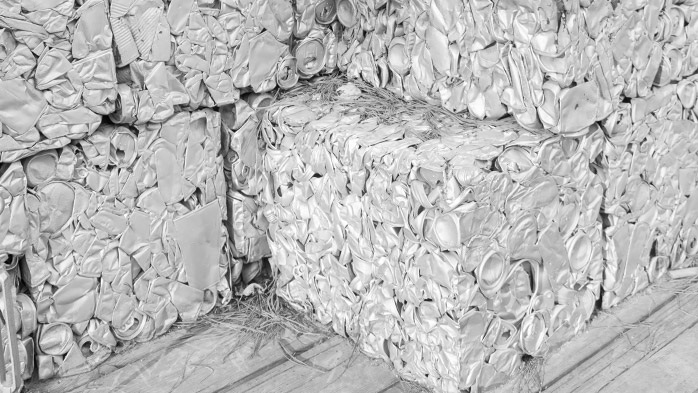

Aluminum Scrap Markets

January 7, 2025

Dec survey overview: Stuck in limbo

Written by Gabriella Vagnini

The aluminum and scrap markets are currently facing a mix of challenges and cautious optimism as industry players navigate fluctuating supply and demand conditions.

Scrap market dynamics

Manufacturers and mills are reporting an unbalanced scrap market. Some mills believe that the supply of mid to high-value scrap has been mostly reprocessed, but there is an ongoing need to invest in more efficient processing methods for lower-value scrap. One mill mentioned that unsold tons are accumulating as weather and interest rates take a toll, while another cited supply tightness, especially in automotive virgin scrap. However, many still believe there’s enough scrap supply in the U.S. and Canada to meet projected demand, even with new electric furnaces coming online.

Processor and smelter perspectives

On the processor and smelter side, there’s mixed feedback. Some processors are seeing an oversupply, particularly when tariffs and export dynamics are factored in. A few processors noted that reduced industrial production and further consolidation within the recycling sector could impact scrap flow. Yet, many feel stable supply is available, though challenges remain with the unpredictability of tariffs. The recent resignation of Canada’s Prime Minister has added uncertainty, with expectations that President Trump may implement tariffs, especially since Canada won’t select a replacement until Q4.

Challenges for scrap dealers and recyclers

Scrap dealers and recyclers are facing a similar sense of imbalance, with the market being described as “slightly oversupplied” or “slow.” Many cited economic factors such as interest rates, weather, and pricing uncertainty as obstacles hindering scrap flow. A few recyclers mentioned issues with trucking logistics and transportation, with one noting that rail logistics were “underdelivered.” This has made it harder to ensure timely delivery of materials, adding another layer of difficulty in keeping the market balanced.

Demand outlook

Regarding demand, the picture is more optimistic in some sectors. Manufacturers and mills generally see demand improving, but it’s not universal. Some mills note seasonality and high-interest rates as factors pulling demand down. In contrast, processors and recyclers note stable or slightly declining demand, with scrap flow expected to be reduced during holiday months. Some scrap dealers and brokers are particularly concerned about the lack of demand from mills, which has affected their tonnage, even with some seasonal upticks in export prices.

Price expectations

Price expectations are another area of uncertainty. Scrap dealers, processors, and brokers expect some fluctuation, with busheling prices trending in the $400-449 range for the coming months. While some expect slight price increases, with export prices likely to play a role in price support or drag, export demand for aluminum scrap, especially to countries like Turkey, has seen a slight recovery, which could lend some support to the market.

Market outlook

Looking forward, the outlook for aluminum and scrap markets appears mixed. While there is potential for recovery in certain areas, especially with improved export prices, ongoing challenges with supply and demand imbalances, as well as logistical constraints, will continue to keep market participants on their toes. The uncertainty surrounding tariffs and trade policies, particularly for aluminum and nonferrous scrap, will likely remain a key point of focus in the coming months.