Scrap Musings for December

Scrap discounts remain exceptionally wide to the Midwest transaction price. Some seasonal tightness may occur, but still affords rolling mills and extruders excellent earnings potential.

Scrap discounts remain exceptionally wide to the Midwest transaction price. Some seasonal tightness may occur, but still affords rolling mills and extruders excellent earnings potential.

Aluminum Market Chatter from survey respondents.

This is Part Two of a look at the commercial trucking sector and its impact on aluminum.

The Millersburg site will add a production facility to Ball’s Pacific Northwest portfolio, just over a year after the company shuttered its can manufacturing plant in Kent, Washington.

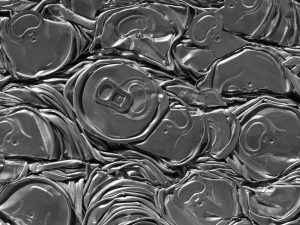

Expectations for UBC scrap prices remained stable in October. What shifted was the composition of the remainder.

AMU's latest survey of aluminum market participants shows widening gaps in lead times, with extrusions lengthening dramatically.

The third quarter already showed an HVAC market weakened considerably due to falling consumer demand and destocking at manufacturers and distributors.

There’s a lot of news to keep track of, so we’re lending a hand with highlights from the past month and what they mean for you.

Upgrades of transmission lines translates into new demand for Aluminum Core Steel Reenforced electric cable.

The Aluminum Association is urging the U.S. government to ban exports of used beverage container (UBC) scrap to keep high-quality recycled aluminum within North America and strengthen domestic supply for manufacturers.