Carbon Neutral Initiatives

December 16, 2025

AMU Community Chat: Grifone talks CBAM, tariffs and the global economy

Written by Stephanie Ritenbaugh

We may have been working in a global economy for a time, but that has changed as markets have fragmented, leaving an aluminum market that is regionalized and harder to balance quickly.

“It means that it’s not so easy and quick to balance and, say, modify the flows,” said Massimo Grifone, commercial director of Cauvin Metals.

Italy-based Cauvin Metals is an important trader of primary aluminum, primary aluminum alloys, zinc, and lead. The company also offers financial, logistics, and hedging services.

Grifone was the featured speaker on AMU’s Community Chat on Dec. 4, when he also discussed decarbonization efforts in Europe, US tariffs, and the changing global metals market.

“People, traders, buyers – often we go on working, keeping some old ideas of how things work in our head,” Grifone noted. “The global economy as we knew it for many years has gone, and we have this sort of selective global economy – markets into markets.”

Looking at the global aluminum picture, the US is characterized by high premiums, Europe is short, and Asia is more balanced. In fact, Asia will likely be in a surplus as China’s investments in Indonesian production ramp up.

Decarbonization

The European Union aims to be the biggest “green market” in the world, emphasizing low-carbon production, reduced emissions, and carbon taxes.

“One of the key takeaways I would like to leave for today’s discussion is that at the end of the day – and also because of this decarbonization process in Europe, primary aluminum isn’t just a commodity anymore. It’s now a product.”

The EU is preparing to implement its Carbon Border Adjustment Mechanism (CBAM) on Jan. 1, which is “sort of a nightmare here in Europe,” Grifone said.

“The idea behind it makes sense,” he said. “In Europe, the industry is subject to this cost, which is basically the carbon cost.”

“But the way they want to apply this tax is a very complicated and creates a new element of uncertainty,” Grifone said. “Instead of leveling the playing field between producers inside and outside Europe, it just basically further tightens and fragments the European market. So, in Europe, we have a completely new scenario, which has also changed, in a structural way, how we buy, how we purchase, and how we sell aluminum in Europe.”

Tariffs

With on-again, off-again tariffs in play in the US, trade between Canada and the US has pulled back, and Europe is pulling more of that metal from Canada.

“We’ve seen it already this year, especially after June or July, so there is an increasing amount,” Grifone said.

One reason is Canadian metal is duty-free for Europe, while metal from the Gulf, India, or pre-sanctions Russia is subject to a 3% tax. Canadian production is also low-carbon, making it easier to comply with environmental requirements.

If the Mozal smelter in Mozambique does shut down next year in the face of a power-supply dispute, that would make Canadian supply even more appealing.

Grifone noted the majority of Canadian aluminum will likely flow to the US due to geography, but Europe may see more in the future.

Fragmentation

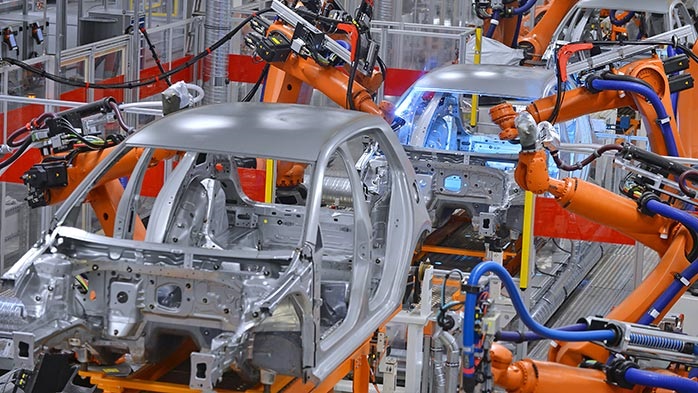

Grifone described aluminum markets as regionalized, meaning it’s no longer easy and quick to balance and modify the flow of the metal, as smaller, fragmented markets are more sensitive to localized factors. He pointed to the automotive sector in Europe, which used to buy auto components worldwide but now struggles to secure the components they need.

“Being a commodity, usually you can replace it easily,” he said. “But for the reasons I explained before, especially in Europe, it’s not a commodity anymore, but more a product. And tariffs can change easily. This basically stops the easy flow, and we need to analyze each market.”