Global Trade

May 7, 2025

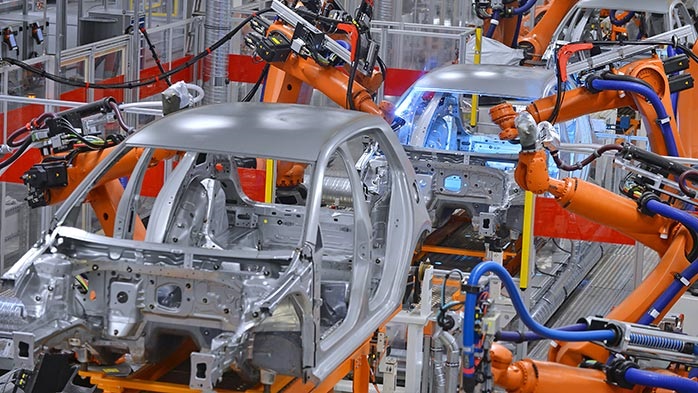

Aluminum takes the wheel: Passenger car reaches a crossroads

Written by Nicholas Bell

For domestic automotive manufacturers, first quarter earnings results defined by a familiar theme: suspended guidance and constant references to “tariff uncertainty”.

Ford Motor Group was the last of the “Big Three” to report Q1 results, following General Motors (GM) and Stellantis in withdrawing 2025 guidance amid mounting tariff concerns.

Ford’s earnings release came just after tariffs on auto parts took effect, including more recent amendments providing recourse for recouping some parts imported for the purpose of assembling a vehicle in the U.S.

While each company referenced “tariff-related uncertainty” in earnings calls, a shared drag across the board was the continued slow death of U.S. passenger vehicle demand.

The most recent sales breakdowns across the Big Three were already saturated with pull-forward sales ahead of tariffs of SUVs and trucks, because those vehicle types tend to be the focus of Mexican facilities.

Ford has already shed most of its passenger vehicle offerings in general, but there are still some legacy cars it produces – like the Ford Mustang. That said, passenger car sales plunged by 32% to 9.3mn in the first quarter.

GM posted a sharp drop in passenger car sales within the U.S. of almost 66% to 17mn units – which would only represent 2.5% of the U.S. passenger car market if that was normal, by the company’s estimates.

The last of the three (and hardest to pull any meaningful data from) – Stellantis – recorded a 77% drop in passenger vehicle sales and ended the quarter at 5.3mn. For those counting, that would represent 7/10ths of 1% of the U.S. market share using the same estimates GM provided.

The market share estimates will likely have to use a different baseline for passenger vehicles in the year to come.

That said, while domestic automotive end market is slated for some headwinds, the lightweighting narrative is one that has stuck. This seems to be particularly true for the U.S., where less-aluminum intensive passenger vehicles are rapidly losing market share.

Detroit’s aluminum hierarchy

Ford appears to be the most insulated from tariff exposure and shifting aluminum dynamics.

To be sure, GM has more North American nameplate production capacity, followed by Ford and then Stellantis. When it comes to auto parts, that greater production capacity seems to also have support from less exposure, as long as the components meet USMCA compliance. But there’s two issues with that theory.

General Motors also represents the largest share of US auto imports than any car company. Not the Big Three of any car company.

Second, if you take away the production capacities of GM’s Mexico and Canada plants (as well as Stellantis’), Ford has the largest share of US nameplate capacity with none of the wrought aluminum tariff exposure.

Ford’s current US capacity utilization rate is about 80%. That’s a decent clip higher than the 69% average in the US in 2024, especially as dealers have built up inventory and all vehicle producers expect heightened input costs to dampen demand for new cars.

Tangentially, the bulk of Stellantis’ business is conducted in Europe and the diversity of brands under their umbrella in the US could be a liability more than an asset. Each plant in the US is segmented across distinct operating divisions.

While GM focused on upping their recycled steel inputs and Stellantis pledged decarbonization targets, Ford established closed-loop aluminum scrap recycling programs and casting facilities. Ford’s share of aluminum scrap in the US is sizable, not to 100% of their automotive sheets is sourced in the US.

Either way, using U.S. Geological Survey data of net receipts of new aluminum scrap and Ford’s internal recycling metrics, they could possibly account for around 7-8% of pre-consumer scrap inflows in the US. So, they’ll have a huge bearing on aluminum scrap recyclers either way.

As tariff pressures mount and production strategies diverge, Ford’s domestic footprint and aluminum-forward strategy may make it the most relevant of the Big Three to watch in the evolving aluminum landscape.