Global Trade

February 9, 2026

Edward Meir's Week In Review: Feb. 9, 2026

Written by Edward Meir

Last week was another wild time for the markets.

Base metals

In the base metals space, all six metals finished down, although the group managed to pare its much steeper declines by Friday. By week’s end, copper, aluminum and zinc ended down between 1.2%–1.9%. But nickel and tin did not fare as well, off by about 5% and 10% respectively. Lead finished 2.4% lower. It was the least volatile metal in the group.

Sentiment was further degraded by accumulating inventories. In copper’s case, LME stocks are at their highest levels since May 2025 (at 183,000 tons). Stocks on the Shanghai Futures Exchange climbed for a ninth week in a row to just under 250,000 tons. Comex/CME copper holdings are at a record 532,000 tons, held as sort of “insurance stock” against US tariffs being imposed on copper products and possibly on copper cathodes by year-end.

Precious metals

Trading was frenzied in precious metals, as well. Gold rebounded on Friday and managed to close out the week higher at $4,988/ounce, but not before sinking to a 2026 intraday low of $4,423/ounce at one point. Bargain hunting and uncertainty over the US-Iran talks being held in Oman helped prices revive.

Silver rebounded to settle at just under $77/ounce on Friday but sank to a three-month low of $63.90 earlier on Friday. Of all the precious metals, silver has been prone to the most speculative activity. In this regard, we learned that one Chinese trading firm made a whopping $500 million last Friday shorting the metal. In an attempt to cool off the big price swings, the Chicago Mercantile Exchange increased margins on both silver and gold for a third time last week.

Energy

WTI ended about $1.60/barrel lower on the week at $63.55. Brent settled a shade above $68, down by about $2.60. The crude complexes were pressured when Iran-US talks proceeded as scheduled on Friday after doubts as to whether they would even start. The two sides seem to have made some progress and will continue their discussions. But we think the differences are so stark that securing a deal will likely be difficult.

Meanwhile, Saudi Arabia lowered its official selling price of Arab light to a five-year low last week. It marked the fourth straight month of price cuts.

On the inventory side, the latest EIA weekly report showed crude stocks fell by about 3.5 million barrels. That brought overall levels roughly 4% below the five-year average. Gasoline inventories rose by 700,000 barrels, about 4% above the five-year average. Distillates dropped by about 5.6 million barrels, putting them 2% below the five-year average.

Natural gas prices settled at $3.42 on Friday, off by about $0.93 week over week (down roughly 21%). Although cold weather continues to grip much of the eastern US, speculative length in natural gas has receded as investors are starting to discount warmer temperatures. Separately, gas inventories fell by a massive 360 bcf this past week for a record withdrawal. Natural gas stocks are about 1.7% over year-ago levels but lag the five-year average by about 1%.

Equity markets

US equity markets saw large swings last week in nervous trading. Weakness in many technology names, chip stocks and software companies was widely evident. Software companies are pressured by concerns about more versatile AI software that could displace a myriad of applications. Bitcoin prices dropped to near 18-months lows last week before recovering slightly on Friday, pressuring a number of companies in the AI and data center space in the process.

A massive rally Friday fueled by bargain-hunting of beaten-down names managed to lift all three equity indices well off their lows. In fact, Friday’s 1200-point rally in the Dow briefly took the index above 50,000 for the first time ever before the index retreated below that mark by the close. For the week, the Dow was up by 2.5%, the S&P 500 finished just about flat, while NASDAQ ended down 1.8%.

Currency

In the currency markets, the general dollar index ended the week higher despite treasury yields slipping slightly for the week. The 10-year ended the week at 4.22%, down four basis points. Two-year yields finished at 3.5%, off three basis points.

Trade

President Trump announced a deal with India last week that slashes US tariffs on most Indian imports to 18% from 50%. In exchange, India will hold off buying Russian oil. India will also lower its own tariff barriers on US goods. Over the weekend, India said it will slash duties on high-end American cars to 30% from as high as 110% and eliminate tariffs on Harley-Davidson bikes. But it will not make any concessions for EVs, a move that pointedly leaves Tesla out in the cold. The US said India also agreed to buy some of its oil from the US and potentially from Venezuela. It is not clear what the deadline is for India to transition away from its Russian purchases or, for that matter, when the reduced tariffs will kick in.

Corporate news

In corporate news, Rio Tinto and Glencore have abandoned plans for a $260 billion megamerger. Apparently, the two sides came to an impasse over price. Both companies noted the current deal would not deliver value to either shareholder group. Glencore’s shares fell by 10% on Thursday after the announcement, while Rio Tinto dropped by a more modest amount.

Separately, Glencore announced a nonbinding deal last week to sell a 40% stake in its copper-cobalt mines in the Democratic Republic of the Congo to Orion Critical Minerals Consortium. The investment group is backed by the US government.

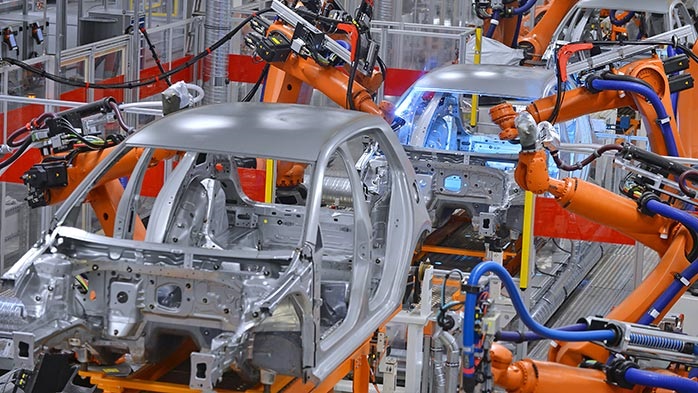

Remember the days when carmakers were piling into EVs, prodded both by government deadlines along with their own aspirations? Now, they are leaving just as fast, taking massive write-downs in the process. Stellantis was the latest to do so after the company announced a $25 billion write-down, sending its shares down a whopping 30% on Friday. The company’s CEO admitted the company overestimated “the pace of the energy transition.” Executives said the firm is on track for a big loss during the second half of the year. Ford and GM took write-downs of their own last year, as slowing EV sales, coupled with competition from superefficient Chinese manufacturers, have hobbled Western efforts to expand their EV business.

ArcelorMittal said it intends to double electric-arc furnace capacity at its Calvert, Ala., facility. The site has a capacity of 1.5 million tons per year. It is expected to reach full capacity by mid-2026. The company also reconfirmed it had signed a seven-year domestic slab supply agreement with Nippon Steel and US Steel to ensure the facility can meet its needs for delivering US-made material.

Reuters reported Chile’s copper production is expected to grow by 3.7% this year from 2025 to 5.613 million metric tons. Production in 2027 is expected to increase by another 6.4% to 5.973 million tons.

A London court ruled Trafigura was the victim of a nickel fraud “on a grand scale” perpetrated by Indian businessman Prateek Gupta. Trafigura faced losses of almost $600 million after discovering containers of nickel bought from Gupta contained low-value nickel instead. Gupta alleged senior Trafigura executives knew what they were buying was not LME nickel.

Economic indicators

The preliminary February University of Michigan consumer sentiment index came in at 57.3 (consensus 54.3), up from the final January reading of 56.4.

Consumer credit increased by $24.0 billion in December (consensus $8.4 billion) following a $4.7 billion increase in November. The key takeaway is there was a healthy expansion in credit in December, driven by solid pickups in both revolving and nonrevolving credit. In fact, the December expansion was the biggest since March 2025.

Last week brought disappointing news from the US labor market. Initial weekly claims rose by 22,000, coming in ahead of expectations. Job openings for December fell to 6.542 million from a revised 6.928 million in November. The January ADP employment report showed an increase of 22,000 jobs after a downwardly revised 37,000 increase in December. The number fell short of the 45,000 expected. The January nonfarm payroll number was supposed to come out on Friday but will be released this week instead.

The ISM manufacturing index came in at 52.6 for January, well above the consensus estimate of 48.3. It also came in above December’s reading of 47.9. The foray into expansion territory breaks an 11-month contraction streak for the index. The rebound was helped by a 10-point surge in the new orders index, now at its highest level since February 2022. The production index jumped by about six points to 55.9, as did the order backlog index. The employment index rose 4 points to 48.1%. But importantly, the prices paid index was unchanged at 59% versus December levels.

The ISM services reading for January came in unchanged last month at 53.8 amid a three-point drop in new orders and a whopping 10-point drop in exports. Eleven service industries, including utilities, construction, retail trade, accommodation, and food services, all reported expanding activity, but five industries—wholesale trade and transportation, along with warehousing—reported contraction.

Comments from the construction industry pointed to expectations for “significant business growth in 2026,” as data center buildouts continue. However, uncertainty surrounding tariffs remains a concern for most. On the employment side, most companies are holding off on new hiring.

The Trump administration is proposing to fund a $12 billion critical minerals stockpile as part of an effort to counter China’s role in this space. The US Export-Import Bank will provide $10 billion in debt financing so “essential raw materials” across the US can be made available for sale. Some of the commodities stored include rare earths, copper and lithium and three trading companies—Traxys, Mercuria and Hartree Partners—will be responsible for securing this material. Reuters reports “more than a dozen companies including Lockheed Martin, General Motors, Alphabet’s Google and battery maker Clarios have already signed up to become [members of the stockpiling program]. They will pay a fee that secures the right to withdraw minerals from the stockpile in emergency situations when they are struggling to source the materials on the open market.”

Not to be outdone, China announced that it, too, will create a stockpiling system led by state-owned enterprises, targeting copper and copper concentrates in particular. This is the new trade world we find ourselves in, as described by a panelist at the Future Minerals Forum held recently in Riyadh, Saudi Arabia, as an era of “strategic mineral nationalism.” This new construct is replacing the relatively free flow of goods in place for decades, with the US being the anchor buyer on account of its low tariffs. This was not a perfect system, but it was far more predictable and efficient than the model we seem to be moving toward.

Private-sector PMI readings released out of China last week by S&P Global had factory activity expanding slightly in January, to 50.34 from 50.1, in contrast to the official PMI reading that came out the day before showing a dip back into contraction territory.

Elsewhere out of Asia, Japan’s PMI rose to 51.5 in January from 50.0 in December, the strongest reading since August 2022. South Korea’s PMI came in at 51.2 from 50.1—the highest since August 2024. Factory activity in Malaysia, the Philippines and Vietnam expanded in January. And so, for the first time in a long while, we seem to be experiencing a broad-based global manufacturing recovery.

This week’s US macro readings

Tuesday we get the NFIB January optimism index (expected at 95, unchanged from last month).

We also get December US retail sales (delayed, expected at .5%, prior .6%). The ex-auto December retail sales number is expected to come in at .3% (last .5% ).

Last week’s January non-farm payroll number will come out Wednesday (expected at 70,000, last 50,000 ) with the unemployment rate expected to hold unchanged at 4.4%. Hourly wages are expected to grow by 0.3%, unchanged from last month and are expected to be running at 3.7% year-over-year, ahead of inflation.

Thursday brings us weekly initial jobless claims (expected at 222,000, last 231,000). January existing home sales also will be released (expected at 4.15 million, last 4.35 million).

Friday, we get the January CPI number (expected at 0.3% , unchanged from last month), while the year-over-year reading is expected to drop to 2.5% (from 2.7%.) Core CPI is expected to come in at 0.3% (last .2%) with the annual rate dropping slightly to 2.5% (from 2.6% ).