Global Trade

July 22, 2025

Hydro to cut spending guidance amid economic uncertainty

Written by Stephanie Ritenbaugh

Norwegian aluminum producer Norsk Hydro announced it is cutting its’ capital expenditure guidance and freezing hiring white-collar workers due to “global market uncertainty.”

Hydro is reducing its CapEx guidance for 2025 by NOK 1.5 billion (US $148.6 million) to NOK 13.5 billion (US $1.3 billion).

“In the current situation, our focus is on preserving financial strength, improving capital efficiency, and maintaining room to maneuver,” Eivind Kallevik, president and CEO of Hydro, during the company’s Q2’25 earnings presentation.

“We have, so far, not seen big changes to our operations from tariffs and potential trade wars. Our main concern is whether the uncertainty will lead to a global economic downturn.”

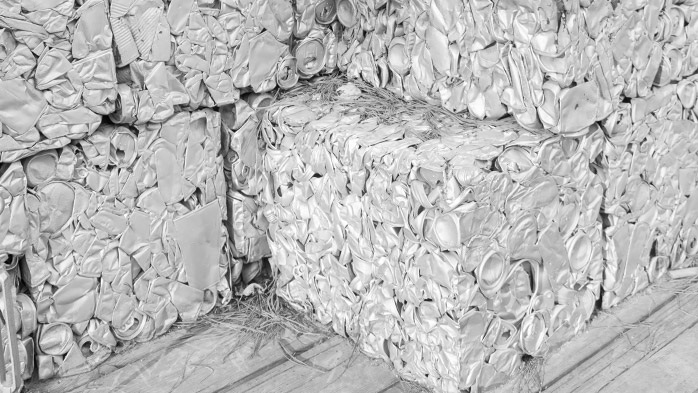

Kallevik noted that most of the CapEx guidance was targeted on Hydro’s recycling and extrusion businesses.

“Without going into any specific projects, that’s where you should expect the reduction to come for 2025,” he said.

Hydro, which operates in more than 42 countries, has 28 locations in the United States, five in Canada and two in Mexico.

“Geopolitical unpredictability has become the norm rather than the exception, in particular, in the years following Russia’s invasion of Ukraine,” Kallevik said. “And this is now well into its fourth year. Rivalry and rhetoric between great powers is becoming even more pronounced and tensions in the Middle East have escalated beyond gas, including Lebanon, Syria and Iran in just the past few months.”

“Countries are facing direct threats, global markets are under pressure, and this is weighing on consumer confidence. And in the U.S., the Trump administration has completed its first six months and we’ve seen constant changes related to tariffs and to trade,” he said.

Trade

President Trump doubled Section 232 tariffs on aluminum to 50%, effective June 4th.

That change impacted both the London Metal Exchange (LME) and the Midwest Premium.

Hydro’s estimate of the global primary aluminum balance projects a roughly balanced market in 2025, though continued tariff changes could force a downward revision to its’ global alumina outlook.

Regional premiums were materially impacted by tariffs during the quarter, widening the gap between different regions, Hydro said.

The U.S. Midwest Premium surged from $844 per metric ton (t) to $1,432/t during Q2’25, driven by the tariff hike and speculative trading. On the other hand, the European duty-paid standard angle premium declined from $205/t to $285/t, reflecting weak demand and anticipation of greater availability of Canadian metal stemming from redirected trade flows.

“This divergence in regional premiums highlights a growing imbalance in how different regional markets are absorbing the effects of trade policy and geopolitical risks,” the company stated.

Power contract shut off

Hydro also announced the voluntary termination of its power purchase agreement (PPA) with Cloud Snurran AB, a Swedish supplier of wind-generated power. As a part of the settlement, Hydro is entitled to up to €90 million ($105.8 million) in compensation.

Hydro Energi AS signed a long-term PPA with Cloud Snurran in 2018 for an annual baseload supply of 300 gigawatt per hour (GWh) for 2020-2030, and 550 GWh for 2031-2049. However, Cloud Snurran hasn’t delivered since November 2024, citing financial challenges.

On July 17, 2024, the Svea Court of Appeal approved Cloud Snurran AB’s application for restructuring under the Swedish Restructuring Act, overturning an earlier decision by the Stockholm District Court. The reorganization process has now been terminated, as has power delivery to Hydro. Hydro’s ultimate compensation will depend on the realized value from a future sales process, as well as an agreed value-sharing mechanism, according to the company.

Hydro’s Norwegian smelters have power sourcing agreements through 2030, based by an average annual equity hydropower production of 9.4 terawatt hours (TWh) and a contract portfolio of around 8.5 TWh per year, according to the company.

“As several existing long-term power agreements will begin to expire at the end of 2030, Hydro is actively pursuing a range of available sourcing options to meet the demand for cost-competitive renewable power to its operations,” Hydro added.