Global Trade

May 8, 2025

Week in Review: Aluminum holds ground, but pressure builds beneath it

Written by Gabriella Vagnini

LME faces crosswinds from tariffs and trade optimism

LME pricing is holding steady despite pressure from new tariffs, shifting interest rate policy, and uncertain trade deals. Activity picked up after news of a possible U.K. deal and China stimulus. Powell’s comments this week confirmed that interest rate cuts remain off the table, reinforcing tighter monetary conditions even as tariffs raise costs. Currency movement is becoming a key driver as the market looks for direction.

Watch for: May as it is historically a month of volatility for LME aluminum. LME spot or three-month has made sharp moves in May driven by traders positionings, China production shifts and USD volatility. This is key to watch as the LME remains base for primary, secondary, and scrap pricing across the supply chain.

European billet and ingot premiums show signs of a split outlook

Rotterdam premiums are flat, but market chatter suggests billet premiums may climb while ingot sentiment stays cautious. Auto sector demand is still uncertain, and the B&C sector remains sluggish.

Watch for: signs of Q2 strength among extruders and how Russia phaseouts affect ingot flows.

US Midwest premium softens but finds footing

Premiums ticked slightly lower but are now adjusting to new tariff realities. Lower LME prices and calm ocean freight are helping keep replacement costs down.

Watch for: macro-driven demand weakness and whether premiums stay near current floors.

Japan and South Korea spot premiums slip further

Spot premiums in Japan and South Korea both fell again this week. Market players expect MJP Q3 numbers to settle below Q2 as demand remains soft and supply is stable.

Watch for: MJP Q3 negotiation outcomes and downstream buying behavior.

Century earnings show tariffs help margins but not volumes

Century Aluminum saw better margins thanks to higher LME prices and Section 232 tariffs, but volumes are flat. To meet full-year goals, Mt. Holly will need to boost utilization by 11 percentage points to hit full-year guidance.

Watch for: Mt. Holly utilization and progress on new smelter planning in the Midwest.

Ford stands out as the aluminum barometer in auto

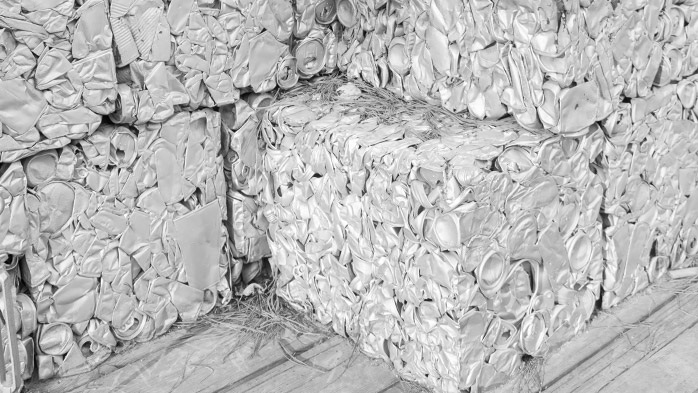

With guidance pulled across the Big Three, Ford’s position looks strongest. It’s sourcing aluminum domestically, recycling pre-consumer scrap in-house, and operating at 80% capacity which is well above the industry average.

Watch for: Ford’s scrap inflows and aluminum usage to guide the broader market.

U.S.–U.K. trade deal could shape aluminum flows

While historically there hasn’t been significant aluminum trade between the U.S. and U.K., the deal still sends a message. It hints at a potential framework for deeper metals alignment, especially around recycled content or environmental standards. Just as notable is who signed first, the U.K., not India.

Watch for: any specifics on recycled content or environmental standards tied to the deal. Also watch how this deal sets precedent for future agreements with India, Canada, or the EU.

CRU slashes outlook on tariffs and softening demand

CRU downgraded its economic forecast, citing tariffs, inflation, and consumer exhaustion. Auto, construction, and parts suppliers are under pressure.

Watch for: tighter lead times and softening orders as downstream buyers get cautious.

NMTC freeze could pinch aluminum construction demand

While NMTC projects aren’t a major driver of aluminum, they still matter for visibility and recycled metal use in light commercial builds. The freeze raises a flag about where else public funding might stall.

Watch for: delays in community projects and signs of broader funding bottlenecks.

FTZ and bonded warehouse strategies still matter

FTZs allow processing and scrap disposal without paying duty on waste. The final product gets a new tariff rate based on its classification after manipulation. Bonded warehouses don’t allow processing; however, the duty rate is set when the goods leave the warehouse, not when they enter.

Watch for: more companies shifting between FTZ and bonded setups based on cost, compliance and duration.

Mexico’s Manzanillo port gamble may clash with US tariffs

Mexico is expanding Manzanillo port, expecting to triple capacity by 2030. But the US tariff posture and upcoming USMCA renewal could disrupt that long-term bet.

Watch for: whether maquiladoras shift sourcing to meet USMCA and tariff constraints.

Rail freight data signals pre-tariff front-loading

Rail volumes for trailers and containers jumped, as shippers front-loaded goods ahead of tariff hikes. Metals shipments nudged higher, but Q2 trends will be more telling.

Watch for: intermodal declines and metals shipment dips post-tariff implementation.

Earnings footnotes show stress under the surface

Big names like Constellium, Kaiser, Hydro, and Granges reported solid top lines, but a closer look shows thinner margins, hedging gains masking flat earnings, and weak auto sales dragging performance.

Watch for: pressure in extrusion and rolling profitability, and more caution on outlooks.