AMU Community Chat: Grifone talks CBAM, tariffs and the global economy

“The global economy as we knew it for many years has gone and we have this sort of selective global economy – markets into markets.”

“The global economy as we knew it for many years has gone and we have this sort of selective global economy – markets into markets.”

Mexico’s Congress authorized up to 50% tariffs on goods from countries with which it does not have a bilateral trading agreement. This is gives Mexico some cover over concerns it bowed to US pressure to block just Chinese goods flowing through Mexico to the US.

AMU and SMU are pleased to announce that Wells Fargo Managing Director Timna Tanners will be joining us for a Community Chat webinar on Wednesday, Dec. 17, at 11 am ET.

When we last reported on Chinese trade, the numbers showed a strong performance for September. Two months later, we see more growth. China shrugged off disappointing October exports of $305.4 billion to record November exports of $330.3 billion, according to data released by China’s General Administration of Customs. That was a 5.9% rise over October […]

The organization is urging the US government to use the United States-Mexico-Canada Agreement to stop unfairly subsidized Chinese aluminum from entering the market.

There’s a lot of news to keep track of, so we’re lending a hand with highlights from the past month and what they mean for you.

The outcome of the investigation by the DOC and ITC would shape the competitive landscape and the structure of the US trailer supply chain for years to come.

Meir spoke last week during an AMU Community Chat on a wide range of topics affecting the aluminum market.

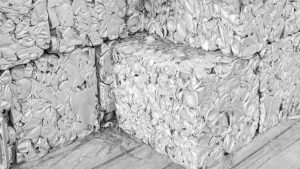

The EU's preparatory work on possible aluminum scrap export restrictions provides the starting point for examining why current European scrap flows to the US remain too small to materially affect either region's can sheet market.

This piece examines how U.S. and EU tariff structures are encouraging new forms of arbitrage and potential circumvention.