Week in Review: Aluminum holds ground, but pressure builds beneath it

Week in Review: May 8, 2025

Week in Review: May 8, 2025

The new trade deal between the U.S. and the United Kingdom (UK) is being called historic, and for good reason. It gives American producers better access to UK markets and puts a hard quota on British car exports. But for metals and recycling, the bigger story may be the creation of what officials are calling a new union for steel and aluminum.

With tariffs back on the table, aluminum companies are feeling the squeeze. While most attention has focused on cost hikes and policy shifts, some critical tools are still in play. Foreign trade zones (FTZ) and in-bond warehousing may not offer the same levers they once did, but they still give companies a way to manage risk, improve flexibility, and stay competitive - especially if you're handling LME-grade primary aluminum or shifting toward recycled inputs.

CRU just took a red pen to its global economic forecast and they didn’t hold back. They’re calling this the biggest monthly downgrade since the pandemic, and tariffs are at the center of it.

Starting June 2, the U.S. Treasury’s CDFI Fund is putting a pause on new applications for Community Development Entity (CDE) certification. They’re calling it a blackout period. It’s temporary, for now, but it’s something to watch, especially if you’re in construction or metals.

April's survey paints a picture of a market holding steady, but it's far from smooth sailing.

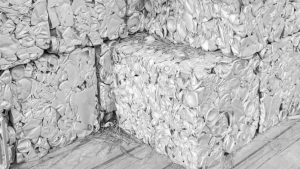

In the U.S., nearly half of the aluminum supply is already coming from recycled material.

“They need a little bit of time,” Trump said this week, referring to carmakers shifting their sourcing back to the U.S. “Because they’re going to make them here.”

A turbulent week in aluminum - Tariffs tighten, prices slip, and the scrap market holds its breath.

Behind every aluminum part swap is a deeper question: is it about innovation or just staying one step ahead of trade rules and sourcing roadblocks?