Global Trade

June 30, 2025

Aluminum's turning point

Written by Gabriella Vagnini

What CRU’s latest outlook tells us, and why it matters for downstream aluminum players

When it comes to long-range metals market analysis, CRU continues to set the bar. Their Aluminum Long Term Outlook (June 2025 update) is one of the most thorough and thoughtful reports we’ve seen on where the global aluminum market is headed, and it has plenty to say to everyone downstream.

This isn’t just high-level forecasting. CRU breaks down evolving demand patterns, supply risks, trade shifts, energy costs, and recycled content trends that hit close to home for processors, remelts, and fabricators. The full report really does deserve a read. We’d definitely recommend clicking through and taking a look for yourself: www.crugroup.com

In the meantime, here’s our quick take on what downstream companies should be paying attention to and how this shapes the playing field heading into the second half of the year.

Short-term pain, long-term resilience

Demand is still underperforming across most regions, and that’s expected to last through the end of 2025. But CRU expects a turnaround in 2026, with a steadier recovery from there. Even though prices might stay soft in the short run, supply won’t keep pace with demand later this decade. That could push prices, and premiums, higher again once the market tightens.

For the U.S.? Expect higher Midwest premiums for the long haul. CRU sees the delivered Midwest price climbing past $4,000/mt by 2030 and over $7,900/mt by 2050. In pounds, that’s $1.64 today climbing to more than $3.60 by 2050.

Tariffs and project delays: a double-edged sword

Higher tariffs and market uncertainty have slowed both demand and investment in new smelting capacity. That might sound bad, but it actually takes pressure off the need for new investment in the short term. For now, that means fewer greenfield projects and more restarts where possible. In the U.S., restarts at Warrick and Mt. Holly are still on the table. Hawesville is off.

What does that mean for you? Don’t count on new domestic primary supply solving your cost problems. Instead, expect continued import reliance and more premium volatility.

Low-carbon aluminum? Still waiting for liftoff

Europe and the US were supposed to lead the charge on low-carbon aluminum. That hasn’t panned out, at least not yet. Demand has stalled, premiums have weakened, and ESG momentum has hit a wall. Japan is the one bright spot, thanks to auto exports driving demand.

For processors working with OEMs that still have ESG goals on their scorecards, this creates a tricky balancing act. Don’t count on low-carbon premiums showing up in your margins anytime soon but keep an eye on where customers are still prioritizing it.

Solar is still solid, but it’s shifting

Aluminum demand from solar panels is still growing, but the frenzy has peaked, especially in China. CRU now expects solar-related demand to fall more gradually over the next 15 years thanks to changes in replacement modeling. That’s a good thing; it spreads demand more evenly.

But there’s a catch: efficiency gains and steel substitution in module frames will keep chipping away at aluminum’s share. U.S. tax credits are accelerating this shift to steel. If you’re servicing the solar industry, it’s time to double down on value-added fabrication and specialized alloys.

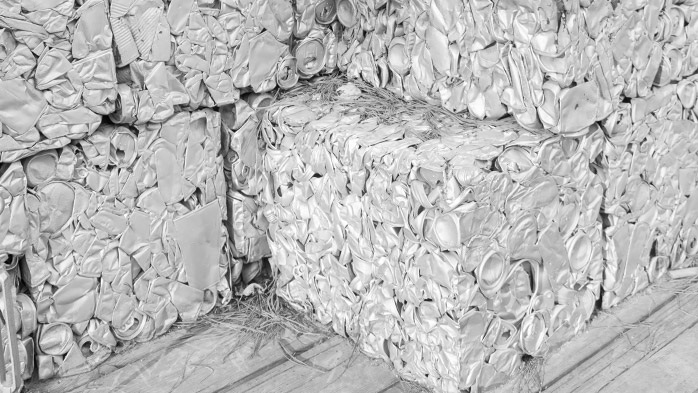

Recycled content is no longer a side story

Recycled aluminum is expected to account for most of the semis growth going forward. CRU is clear on that. Primary demand is slowing.

Recycled content is rising, and that matters for the entire downstream ecosystem.

In the U.S., the combination of elevated Midwest premiums and limited primary production is already nudging the market toward better old scrap collection and domestic sourcing. In China, post-consumer scrap recovery is expected to double by 2034.

If you’re running a remelt shop or buying billet, this affects everything from feedstock planning to sortation specs to how you structure your contracts.

Final thought

CRU’s message isn’t that the aluminum market is in trouble, it’s that it’s evolving. Demand growth hasn’t disappeared; it’s just been postponed. And when it returns, it’ll be more diversified, more recycled, and more regionally competitive than before.

This is a reset, not a retreat. And if you’re part of the downstream aluminum market, it’s time to think ahead and adapt.

This summary is based on CRU’s June 2025 Aluminium Long Term Outlook. AMU is proud to be part of the CRU family and to share these insights with our readers.