Aluminum Scrap Markets

December 16, 2024

China’s new state-owned-enterprise scrap company: Repercussions

Written by Greg Wittbecker

State news agency, Xinhua, announced the formation of a new recycling company called China Resources Recycling Group (CRRG) in October 2024.The venture will have paid in capital of USD 1.41 billion and will be a joint venture of a host of China state-owned companies (SOE).

CRRG will be a joint venture of Baowu Steel (20%), China Petrochemical (20%), Assets Supervision and Administration Commission (20%), China Resources (20%) Aluminum Corporation of China (CHALCO-10%) and China Minmetals (10%).

The size of the capital structure and the composition of the owners is a telling statement about the importance that Beijing is assigned to this venture.

- The capital base will enable it to invest in infrastructure to increase scrap usage amongst sectors that have traditionally been heavily driven by virgin ores and metals.

- The selection of Baowu, CHALCO and Minmetals puts the leading SOE in steel, aluminum, and copper/lead/zinc at the foremost of this venture.

- CRRG has a vision statement of building a national platform for the use of recycled materials and expanding the range of recycled materials.

China has a long way to go to catch up with the World ex China: Opportunity and threat

Let’s put CRRG’s iron/steel recycling goals into some context. CRRG has set out a goal of consuming 260 million metric tons of steel/iron scrap. In 2023, China produced about 1.36 billion tons of steel. This would mean that scrap would constitute about 19.1% of steel output. Big numbers for sure, but they do not rival the recycling performance of the United States.

The U.S. Geological Survey (USGS) estimates that U.S. iron and steel scrap purchases+ imports were 62.7 million tons in 2023. U.S. raw steel production was 80.5 million tons, meaning that U.S. steel producers were using 77.9% recycled content. For China to replicate the U.S. performance, they would need to be consuming about 1.05 billion tons.

CRRG did not stake out a goal for aluminum recycling, but we can provide some context there also.

China now has about 14 million metric tons of installed secondary capacity, with production expected to reach around 11.5 million tons in 2025.

Chinese primary consumption stands around 44.4 million tons for 2024, met by a combination of domestic output (42.6 million tons) +imports from Russia and other Western sources.

If we combine the primary consumption (which equals supply) with the secondary production, their total aluminum consumption from all sources is 55.9 million tons.

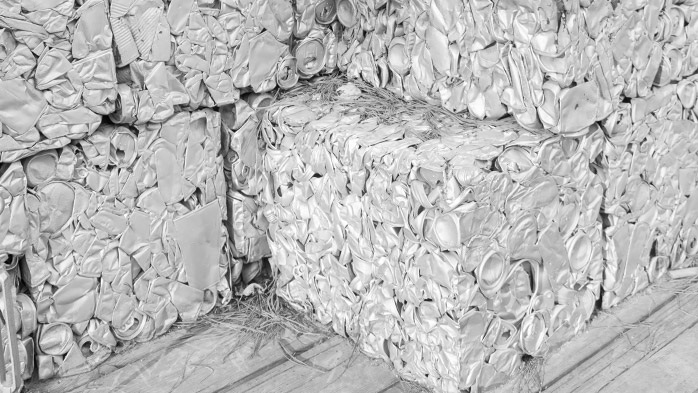

This means that secondary aluminum in China comprises about 20.5% of total aluminum. This pales by comparison with World ex China performance, where products such as 3105 common alloy sheet which is 100% scrap. Can sheet has been produced with 100% recycled content and routinely checks in at 70-75%. Extrusions are 60% or better.

Hence, the Chinese have a long way to go to catch up with the recycling usage of the World ex China.

Something must give either import more Russian primary or boost recycling use

China has a long-standing cap on its primary aluminum production of 45 million metric tons and its demand will outstrip that cap in 2025. If Chinese primary demand grows at a modest 2.5% per annum (about one-half of their GDP target), then primary demand is up 1.1 million tons in 2025 and 2026.

Some would argue that this presents the Russians will a natural opportunity to boost their exports to China, particularly given the fact that Russian metal is low carbon and helps China decarbonization aspirations. However, China may not deem it politically wise to increase its dependency on the Russians and risk the ire of the rest of the World when incorporating Russian metal into products it wants to export.

This is where CRRG starts to come into serious play. China is now on the cusp of “harvesting” its first generation of aluminum obsolete scrap from the housing, auto and transportation boom of the 1990 to 2010 era. The infrastructure needs to get built to accomplish that.

Another basic issue is creating commercial transparency. When the author was based in China, I always asked, “why is it so hard to get decent data on scrap supply, movement, transactions” The answer I got was “because the market operates in either gray or black conditions where ‘fapiaos’ were not commonplace”. A fapiao is a legal invoice or receipt in China that serves as proof of a purchase. The scrap market was, and may still be, a classic example of a cash business operating under the table, outside the view of Beijing.

CRRG will have a big challenge bringing the obsolete grades in the open market, but they clearly have a mandate to do so.

Imports become the bridge until domestic recovery rises: threat to US, EU & Asia mills

While they built infrastructure and change the commercial culture of the domestic market, CRRG may resort to imports to “prime the pump” and boost recycling content.

We have already seen China loosen its restrictions on used beverage container scrap (UBC). Historically, UBC have been banned from importation, being treated as solid waste. That ban is gone and UBC are starting to flow directly to China.

That potentially becomes a big threat to the domestic US mills buying UBC from the West Coast. It also threatens to become new competition for UBC originating in the Middle East which historically have been processed in the region or gone to the EU).

CRRG bears close scrutiny to see their discreet plans for aluminum recycling. At the same time, we are keeping our ear to the ground for signs of a noticeable increase in Chinese buying interest from the US West Coast.