Global Trade

May 2, 2025

The new math of Trump's auto tariffs

Written by Nicholas Bell

More of a tweak than a turnaround

The tariff timeline takes another turn as President Trump walked back his stance on auto part import duties and foreign-assembled vehicle levies.

To be clear – the original 25% tariff on fully assembled imported vehicles remains in place and no decision to rescind the tariff on auto parts beginning next Monday was made.

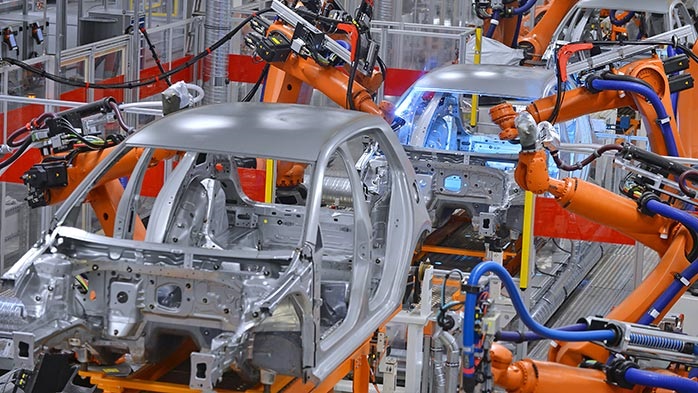

The focus of an impending executive order would reimburse some of the tariffs paid on foreign auto parts by domestic automotive manufacturers producing cars in the U.S. as well as foreign automakers importing fully assembled vehicles, according to an initial report by the Wall Street Journal and later confirmed by administration officials.

An updated version of the report highlighted a modification that would mean that domestic automakers can be reimbursed for the 25% tariff paid on auto parts up to an amount equal to 3.75% of the value of a U.S. manufactured car for one year, declining to 2.5% of the value in the second year.

The purpose of the tapered tariff reduction is to allow time to readjust supply lines or onshore manufacturing to the U.S., a phaseout that incentivizes shifts in components production.

Another anticipated provision whereby automakers paying automotive tariffs won’t also be charged for other duties, like the Section 232 tariffs on aluminum, but these provisions or their effective relevance are difficult to determine.

There’s confusing wording to the legalese involved in these comments. Fully-assembled vehicles wouldn’t be subject to a Section 232 tariff because of the aluminum auto parts comprising its composition, but limited comments were made about the general 10% import tariff and currently-paused reciprocal tariffs from countries like Japan – home of Toyota, Honda, Nissan, Mazda, Subaru, or Mitsubishi.

The Department of Commerce, the Office of the US Trade Representative, and Customs and Border Protection did not immediately respond to a request for clarification.

The curious case of tariff timing

A “coincidental” pivot, the shift comes amid growing economic pressure and as industry pundits voice their concerns a little louder.

General Motors released their earnings report today and withdrew their outlook for the year, citing tariff concerns.

Stellantis will host their earnings conference call tomorrow – the first domestic auto company after the executive order is signed.

By the weekend, auto parts tariffs will go into effect on Saturday, and the world will come back to Ford Motor Group’s earnings on Monday – the first domestic auto company earnings call since the tariffs were put into place.

Three qualitative earnings calls and equity market reactions, cleanly staggered: one from the Big Three before the executive order and auto parts tariffs, one after the executive order and ahead of the auto parts tariffs, and one after the executive order and auto parts tariff.

A speech meant to commemorate the first 100 days of Trump’s second term may provide more clarity tonight, which will take place in Macomb County, Michigan – home to auto plants operated by each of the “Big Three” domestic automotive manufacturers.