Global Trade

January 6, 2026

New Year's resolutions for the aluminum Industry

Written by Greg Wittbecker

As we embark on a new year, we thought it would be an interesting exercise to outline some of resolutions for the aluminum industry. There are some tactical resolutions in this list that are essential for the companies involved to achieve their financial results for 2026. Some are aspirational and may take more than 2026 to happen.

Primary aluminum

Industry as a whole:

London Metal Exchange (LME) prices to remain above $2,800 per metric ton to provide for investment incentive outside China. The era of China placing a de facto cap on the LME price is ending, coinciding with the China production cap. Now, the market must re-price aluminum to reflect non-China capex costs.

Alcoa:

A successful restart of its San Ciprián refiner and smelter complex in Spain.

Alcoa has struggled with this asset for at least a decade, rooted in problems with power costs. They have now teamed up with IGNIS EQT Holdings to find a sustainable energy solution.

Aluminum Association of Canada/Canada:

First, the organization can work with the Canadian government in Ottawa to negotiate some relief from the US Section 232 tariffs of 50%. A prefect world would be restoration of a total exemption. A more realistic objective might be a rollback to a 25% tariff rate that provides Canada with a unique competitive advantage vis-à-vis seaborne importers to the US.

Second, talks on renewal of the USMCA/CUSMA (Canada US Mexico Agreement) are launched and concluded to provide for:

- Robust enforcement of rules of origin for key sectors, such as automotive.

- Unform tariff structures are agreed to.

- Circumvention is aggressively enforced.

Century Aluminum:

First, a power contract is secured to allow its greenfield smelter project in the US to finally begin construction. Thus far, Century has been frustrated by an inability to get any power company to seriously engage on a long-term power contract with reasonable price boundaries.

Second, the company successfully restores full capacity at its Grundartangi smelter in Iceland which was severely damaged by transformer failure in 2025.

European Commission:

The bureaucrats in Brussels published defined standards for how the Carbon Border Adjustment Mechanism (CBAM) will operate. Jan. 1, saw CBAM go into effect on paper, but there remains uncertainty as to how the mechanics will work, rendering it difficult for both domestic and import producers to ascertain what their carbon tax exposure is. This is also causing uncertainty in the value of duty paid metal.

Emirates Global Aluminum (EGA):

EGA has multiple resolutions for 2026 that relate to its planned greenfield smelter near Tulsa, Ok.:

- A successful negotiation on a long-term power contract with Public Service Co. of Oklahoma (PSO).

- Attracting equity partners for the $5 billion- $6 billion investment in the 750,000 metric ton/year smelter

Indonesia:

Chinese investors, using Indonesia as proxy for their inability to invest further domestically, are able to execute new capacity competitively.

Mexico:

First, transparent import and export statistics are published monthly.

Second, successful USMCA/CUSMA talks are concluded with same goals as those for Canada.

National Development and Reform Commission (NDRC):

China’s NDRC demonstrates its 45 million metric ton/year primary production cap is real. Domestic production creep should approach the cap early in 2026 and it will “push comes to shove” whether the NDRC enforces the cap and stymies brownfield creed and/or forces older capacity to exit the market in favor of new, hydro-based capacity in the Southwest provinces.

Rio Tinto:

Positive feasibility results on its two greenfield smelter projects in Finland and India.

South32:

The company achieves an 11th hour deal to prevent the total closure of its MOZAL smelter in Mozambique. The 580,000 metric ton/year smelter is on schedule to close by March 31, in the absence of a deal. This will result in a USD $60 million charge to South32 and reduce duty paid supply to the EU substantially.

Secondary aluminum

Adaptiq:

Financing is completed and construction is launched on their billet facility near Cincinnati, Oh.

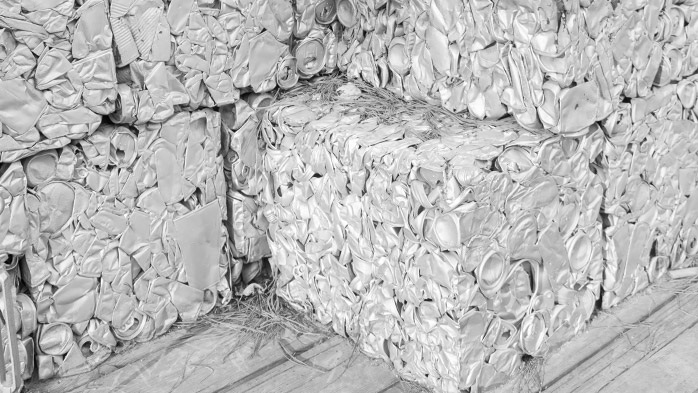

Aluminum Association:

First, adoption of its call for the ban of used beverage container scrap exports and potential of controls on other mill-ready scrap.

Second, the membership supports the continuation of Section 232 tariffs at 50% to preserve current market conditions where scrap discounts versus primary metal remain at historically wide levels.

Automotive scrap:

Increased investment in sortation equipment at point of origin stamping facilities to generate segregated alloys versus mixed low copper clip.

Century/MX Holdings:

Construction begins on their billet facility near Leetonia, Oh.

Sorterra:

Completes construction of their Lebanon, Tenn. processing plant by summer 2026.

Aluminum Rolled Products

Aluminum Dynamics Inc.:

Complete the commissioning of its Columbus, Miss., rolling mill complex during 2026.

Aluminum Foil Container Manufacturers Association:

Complete prosecution of anti-dumping case against China.

Novelis:

First, the company completes the restoration of operations at its Oswego, N.Y., hot mill, damaged by fire during third and fourth quarters 2025.

Second, it executes on smooth commissioning of Bay Minnette, Al., rolling mill during second half 2026.

Truck and Trailer Federal Excise Tax:

Legislation to remove the 12% is passed, acting as a stimulus to new Class 8 truck purchases plus trailers.

Extrusions

Solar panel tax credits:

Restoration of federal tax credits to stimulate both residential, commercial, and utility scale installations.

Truck and Trailer Federal Excise Tax

Legislation to remove the 12% is passed, acting as a stimulus to new Class 8 truck purchases plus trailers.

Freight

Ocean container:

Carriers seek final clarity on US Trade Representative port fees, which are suspended until Nov. 10.

Trucking:

Carriers seek higher rates per loaded mile to compensate for higher insurance costs, litigation awards, and wage inflation for drivers.

Wire and Cable

Copper substitution:

The current price move in copper stimulates further substitution by aluminum in magnet wire applications for motors, medium voltage distribution, and automotive wiring.

Utility capital expenditures for transmission:

Investor-owned utilities and independent transmission operators increase capex for transmission lines, boosting demand for aluminum clad, steel reenforced (ACSR) conductor.