Aluminum Scrap Markets

September 16, 2025

Report: Aluminum demand down in H1

Written by Stephanie Ritenbaugh

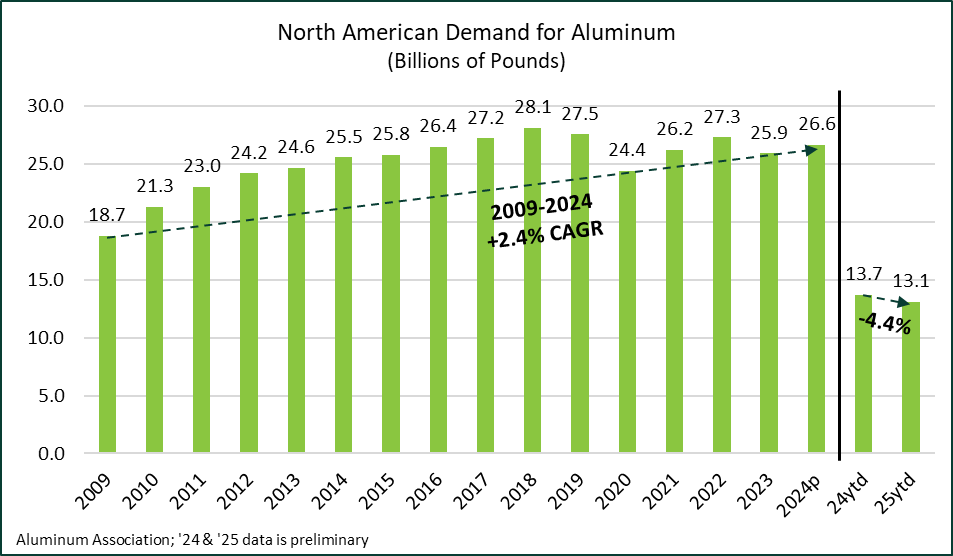

Aluminum demand in the U.S. and Canada slipped by 4.4% during the first half of the year, according to preliminary estimates from the Aluminum Association.

The year-over-year decline was partly due to a significant drop in exports; however, demand fell in all market segments except foil, according to the trade association.

“We are carefully monitoring the market as more data becomes available on how the current tariff landscape is impacting the industry,” said Charles Johnson, president & CEO of the Aluminum Association, in a statement.

“As we look ahead, it’s critical to ensure trade policies support — not strain — the U.S. aluminum industry. With 98% of American aluminum jobs in the mid- and downstream sectors, we need a more targeted trade approach that protects against unfair practices while keeping America’s aluminum industry strong and competitive.”

CRU Group, the parent company of AMU, said in a report earlier this month that despite the negative data, U.S. mills report steady conditions with a positive outlook for the rest of the year.

“The most glaring weakness is still in the commercial trailer market, as build rate expectations for the remainder of 2025 again fell off slightly. This seems to clash with the reported data, but a look into trade flows helps shed some light on what’s driving the weaker consumption in the first half of the year.”

Overall, aluminum demand (shipments by domestic producers plus imports) in the U.S. and Canada totaled an estimated 13.1 million pounds through June 2025, the Aluminum Association found.

Producer shipments from the U.S. and Canada dropped 4.5% year-over-year through June. This number excludes imports to more clearly reflect industry aluminum and aluminum product shipments by North American firms, the Aluminum Association noted. This decline was driven primarily by a decrease in aluminum mill products, which contracted 1.6%, while shipments of aluminum ingot for castings, exports, and destructive uses fell 11% year-over-year.

Scrap inventory increased 14.7% so far in 2025, driven by tariff policy that is incentivizing the use of recycled metals.

Imports of aluminum and aluminum products into North America rose 15.8% year-over-year in the first half, driven entirely by imports of unwrought aluminum, the association found.

The Aluminum Association said the Trump Administration’s 50% tariff on aluminum “risks undoing hard-earned gains and jeopardizes a decade of progress,” in industry investment.

“The Aluminum Association is calling on policymakers to pursue a more focused, targeted approach to trade—one that strengthens the domestic industry without disrupting the 98% of industry jobs that rely on access to affordable aluminum inputs,” the organization stated.