Aluminum Scrap Markets

February 7, 2025

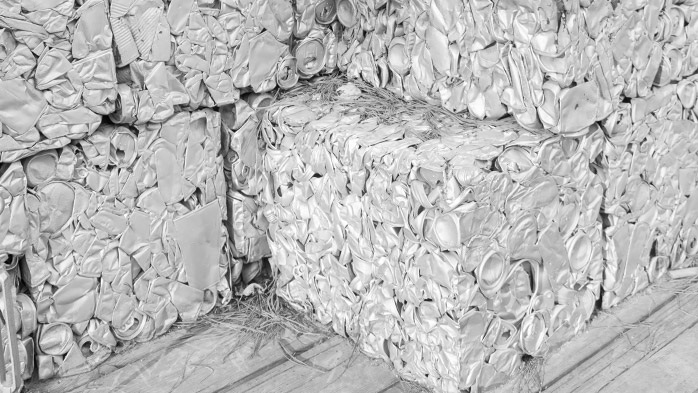

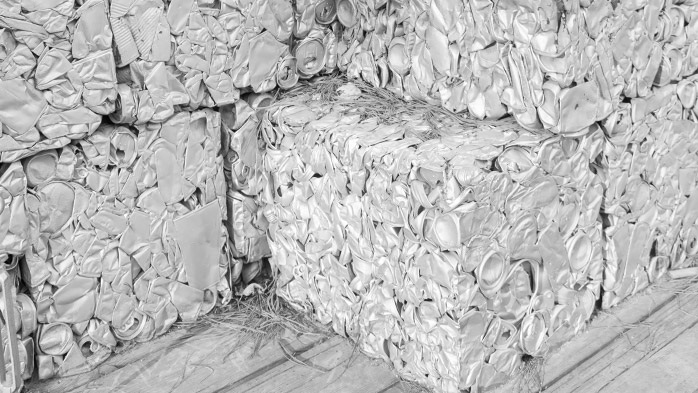

The UBC Market: Untenable Valuation

Written by Greg Wittbecker

In our Final Thoughts commentary last week, we discussed how used beverage container (UBC) price had become expensive.

Conversations at the Platt’s conference centered around what would break the upward trend in prices. As I learned from my oldest mentor at Cargill (when I was a very green and very naïve grain trader), “the cure for high prices is high prices.” That means someone must walk away from the market and take the pressure off the price. It appears one of the major buyers has now done so, with pricing now easing relative to Midwest P1020.

It is tempting to ask, “what took you so long?” UBC at 83% afford zero savings versus melting P1020 or other alternative scraps. The answer is sometimes not that simple.

Some buyers stand in to buy because they are not well bought with sufficient UBC stockpiles to allow them to run their delac (de-coating) lines at capacity and optimize cost. Others may see limited alternative scrap options that are cheaper and still others are fearful that if they start to reach out for more P1020, they will push the Midwest premium higher.

It might come down to buyers determining how much red ink they want to absorb for what period before rotating away from UBC. Some may simply decide to wait out other competition who decides to exit the market before them. I would argue that the STRONGER competition is likely to exit first, because they own enough cans to be able to sustain production runs (and lower costs). The weaker mills without good inventory or forward buys, are scrambling to fill capacity, and they provide that marginal demand that keeps prices elevated.

What’s Next? Rolling Mills EBITDA to take a Hit

It’s good that at least one major buyer did the math and realized it was pointless to keep trying to buy cans at these spreads to P1020. Others may join and they can maintain enough discipline to cause prices to break. However, we are still in Winter, and receipts of cans are notoriously slow then. We won’t see any increase in supply until Spring comes in April or May. It is a question whether the mills can find alternative scraps to run or simply revert to a primary “diet.”

Neither option is very palatable. Over the past 5 years, the reason aluminum rolling mills have enjoyed good profitability has been due to their ability to buy scrap at very attractive discounts to primary metal. Their selling prices for sheet/plate have gone up “some,” but the real driver behind their EBITDA has not been the revenue side, it has been their input costs.

The current tightness in UBC and all scraps for that matter, means that rolling mills are going to report lower EBITDA when earnings are released.

Canada/Mexico Tariff Issues are especially problematic for recycled metals

UBC represent the single most vulnerable grade of scrap affected by cross-border movement from both Mexico and Canada. Processed can scrap, in the form of Class 1-2-3 are also in harm’s way. Much of the processed can scrap finds its way back to the U.S. under tolling deals with the major can sheet mills. We just do not know what exemptions, if any, may emerge from the next month of negotiations.

There have been on-going reports that the industry will be seeking exemptions for scrap from both origins. The challenge will be getting the audience in Washington to make the case. There will be an extraordinarily lengthy line of applicants in Washington seeking exemptions for everything from aluminum to zinc.

Everyone is on edge about the impending tariffs against Canada and Mexico, but rolling mills are acutely aware that the stakes are extremely high for them given the already elevated valuation of UBC.