Global Trade

May 30, 2025

Aluminum in motion: What May 2025 means for your next move

Written by Gabriella Vagnini

This month wasn’t about noise, it was about clarity. Who’s serious, who’s posturing, and what shifts downstream players need to watch. If you’re in the real market, making decisions, placing orders, running plants, here’s what mattered.

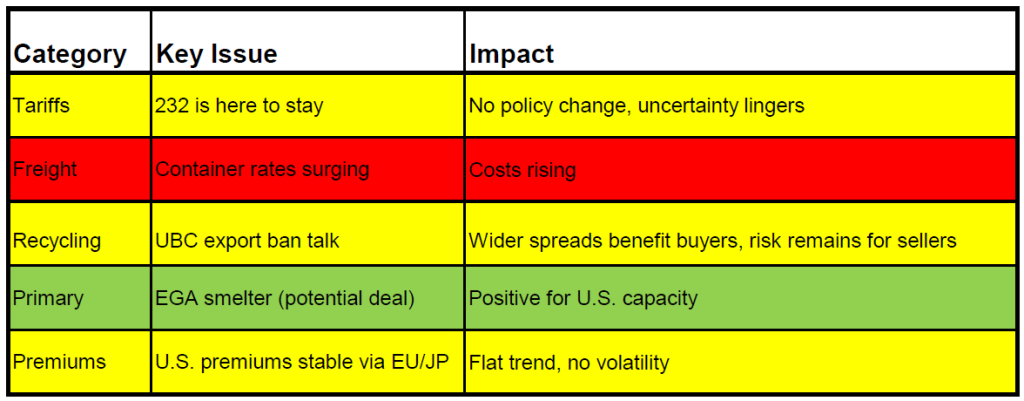

Tariffs made headlines. Power, policy, and freight made the market

- The tariff “pause” on Chinese metal wasn’t a reset. It was a pressure valve. Buyers front-loaded imports, freight costs jumped, and nobody really believed this 90-day pause will turn into a long-term certainty. If you’re hoping for price relief, don’t hold your breath. Read more on this here: Tariff timeout and Tariff rollback freight spike.

- The UK trade deal looked small on paper, but it unlocked a niche opportunity for litho sheet and hinted at closer environmental alignment. If you deal in specialty sheet or clean scrap, this matters more than it looks. Read more on this here: Small deal, sharp edge and The U.S.–UK trade deal.

- Mexico’s port build-out is a long game. If USMCA gets revised in 2026 and tariffs creep back in, that flow shifts again. OEMs are already reassessing their footprint. Read more on this here: Mexico invests in port capacity.

Recycled aluminum isn’t just viable – it’s vital

- The Pure Aluminum deal in Michigan was this month’s most important capacity move. Real tons. Real infrastructure. Built for the market that exists right now. Read more on this here: Traxys teams up with Pure Aluminum.

- There’s chatter around banning UBC exports, but the truth is the domestic system isn’t paying enough to keep material here. If you want more cans to stay local, fix the bid. Read more on this here: Recycled metal export bans.

- Michigan’s proposed tipping fee hike could finally move the needle on recycling. If you make it more expensive to dump, more material gets captured. Common sense, finally. Read more on this here: Logic comes to solid waste.

Freight costs slammed the brakes on shipments

- Ocean container rates out of Asia jumped fast. Aluminum shippers saw costs hit $8,000 in some lanes. Most of it was pre-tariff panic, but shipping lines took full advantage. If you were late to book, you felt it. Read more on this here: Container bookings.

- Bonded warehousing and FTZs got attention again, and for good reason. If you’re tolling, exporting, or trying to stay flexible, it’s time to review your setup. Read more on this here: Why FTZs and in-bond warehousing still matter.

Ford held steady while others slipped

- Ford had a strong first quarter. Domestic sourcing, 80 percent capacity, and solid scrap recovery. They are doing what the policy environment demands, and doing it right. Read more on this here: Ford earnings wrap and Aluminum takes the wheel.

- GM and Stellantis pulled guidance. Passenger car sales fell off. And their overseas plants could take a hit if tariffs shift again. They are exposed in the wrong places right now. Read more on this here: What CRU’s new outlook could mean and auto commentary.

- Novelis is building for tomorrow, but their short-term math is off. Scrap costs are up, contracts are lagging, and even with all their ESG momentum, the pressure is real. Read more on this here: Novelis builds for tomorrow.

Quiet moves that signal big shifts

- Century is benefiting from tariffs, but volumes are flat. If Mt. Holly doesn’t ramp up soon, momentum stalls. Read more on this here: Century benefits from tariffs.

- Teamsters organized at Real Alloys’ Morgantown plant. It didn’t make headlines, but it should have. This kind of labor shift could change tolling terms if it spreads. Read more on this here: Teamsters gain foothold.

- The CDFI fund paused new CDE certifications. That could slow construction projects in low-income areas, which means fewer orders for aluminum-heavy products like door frames and HVAC systems. Read more on this here: CDFI fund freezes.

- Superior lost a major wheel contract, most likely to a Detroit OEM. These kinds of shifts tell you how fast procurement priorities are changing. Read more on this here: What Superior’s lost contract says.

Bottom line for May

Policy shifts. Freight pressure. Labor movement. Recycling momentum. If you’re downstream and not tuned into these signals, you’re going to miss the next big swing. The players who adapt early are the ones who’ll hold share when things tighten.